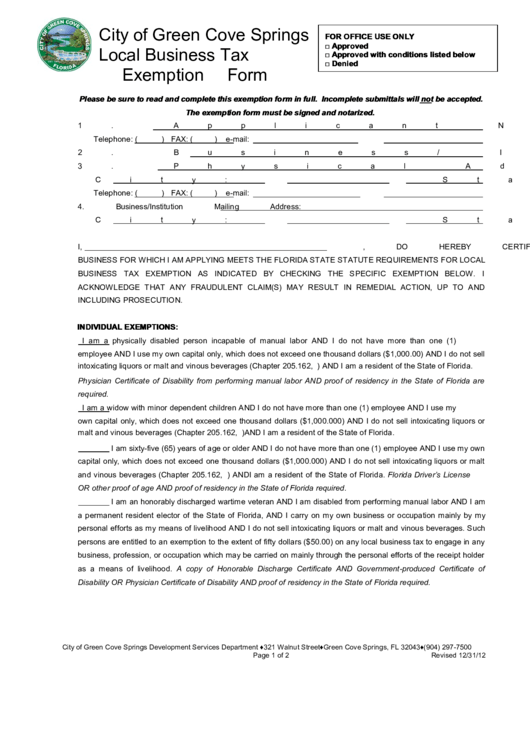

City of Green Cove Springs

FOR OFFICE USE ONLY

□ Approved

Local Business Tax

□ Approved with conditions listed below

□ Denied

Exemption Form

Please be sure to read and complete this exemption form in full. Incomplete submittals will not be accepted.

The exemption form must be signed and notarized.

1.

Applicant Name:

Telephone: (

)

FAX: (

)

e-mail:

2.

Business/ Institution Name:

3.

Physical Address:

City:

State:

ZIP:

Telephone: (

)

FAX: (

)

e-mail:

4.

Business/Institution Mailing Address:

City:

State:

ZIP:

I,

, DO HEREBY CERTIFY THAT I OR THE

BUSINESS FOR WHICH I AM APPLYING MEETS THE FLORIDA STATE STATUTE REQUIREMENTS FOR LOCAL

BUSINESS TAX EXEMPTION AS INDICATED BY CHECKING THE SPECIFIC EXEMPTION BELOW. I

ACKNOWLEDGE THAT ANY FRAUDULENT CLAIM(S) MAY RESULT IN REMEDIAL ACTION, UP TO AND

INCLUDING PROSECUTION.

INDIVIDUAL EXEMPTIONS:

I am a physically disabled person incapable of manual labor AND I do not have more than one (1)

employee AND I use my own capital only, which does not exceed one thousand dollars ($1,000.00) AND I do not sell

intoxicating liquors or malt and vinous beverages (Chapter 205.162, F.S.) AND I am a resident of the State of Florida.

Physician Certificate of Disability from performing manual labor AND proof of residency in the State of Florida are

required.

I am a widow with minor dependent children AND I do not have more than one (1) employee AND I use my

own capital only, which does not exceed one thousand dollars ($1,000.000) AND I do not sell intoxicating liquors or

malt and vinous beverages (Chapter 205.162, F.S.) AND I am a resident of the State of Florida.

I am sixty-five (65) years of age or older AND I do not have more than one (1) employee AND I use my own

capital only, which does not exceed one thousand dollars ($1,000.000) AND I do not sell intoxicating liquors or malt

and vinous beverages (Chapter 205.162, F.S.) AND I am a resident of the State of Florida. Florida Driver’s License

OR other proof of age AND proof of residency in the State of Florida required.

I am an honorably discharged wartime veteran AND I am disabled from performing manual labor AND I am

a permanent resident elector of the State of Florida, AND I carry on my own business or occupation mainly by my

personal efforts as my means of livelihood AND I do not sell intoxicating liquors or malt and vinous beverages. Such

persons are entitled to an exemption to the extent of fifty dollars ($50.00) on any local business tax to engage in any

business, profession, or occupation which may be carried on mainly through the personal efforts of the receipt holder

as a means of livelihood. A copy of Honorable Discharge Certificate AND Government-produced Certificate of

Disability OR Physician Certificate of Disability AND proof of residency in the State of Florida required.

City of Green Cove Springs Development Services Department ♦321 Walnut Street♦Green Cove Springs, FL 32043♦(904) 297-7500

Page 1 of 2

Revised 12/31/12

1

1 2

2