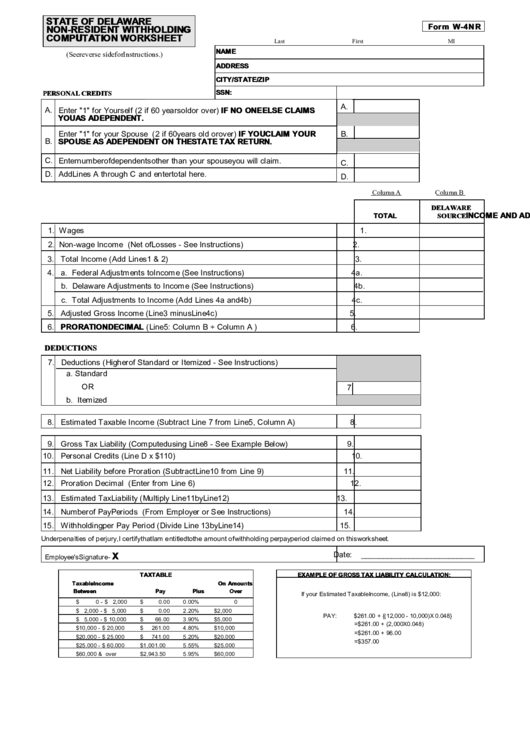

Form W-4nr - State Of Delaware Non-Resident Withholding Computation Worksheet

ADVERTISEMENT

STATE OF DELAWARE

Form W-4NR

NON-RESIDENT WITHHOLDING

COMPUTATION WORKSHEET

Last

First

MI

NAME

(See reverse side for Instructions.)

ADDRESS

CITY/STATE/ZIP

SSN:

PERSONAL CREDITS

A.

A.

Enter "1" for Yourself (2 if 60 years old or over) IF NO ONE ELSE CLAIMS

YOU AS A DEPENDENT.

Enter "1" for your Spouse (2 if 60 years old or over) IF YOU CLAIM YOUR

B.

B.

SPOUSE AS A DEPENDENT ON THE STATE TAX RETURN.

C.

Enter number of dependents other than your spouse you will claim.

C.

D.

Add Lines A through C and enter total here.

D.

Column A

Column B

DELAWARE

INCOME AND ADJUSTMENTS

TOTAL

SOURCE

1. Wages

1.

2. Non-wage Income (Net of Losses - See Instructions)

2.

3. Total Income (Add Lines 1 & 2)

3.

4. a. Federal Adjustments to Income (See Instructions)

4a.

b. Delaware Adjustments to Income (See Instructions)

4b.

c. Total Adjustments to Income (Add Lines 4a and 4b)

4c.

5. Adjusted Gross Income (Line 3 minus Line 4c)

5.

6. PRORATION DECIMAL (Line 5: Column B ÷ Column A )

6.

DEDUCTIONS

7. Deductions (Higher of Standard or Itemized - See Instructions)

a. Standard

OR

7.

b. Itemized

8. Estimated Taxable Income (Subtract Line 7 from Line 5, Column A)

8.

9. Gross Tax Liability (Computed using Line 8 - See Example Below)

9.

10. Personal Credits (Line D x $110)

10.

11. Net Liability before Proration (Subtract Line 10 from Line 9)

11.

12. Proration Decimal (Enter from Line 6)

12.

13. Estimated Tax Liability (Multiply Line 11 by Line 12)

13.

14. Number of Pay Periods (From Employer or See Instructions)

14.

15. Withholding per Pay Period (Divide Line 13 by Line 14)

15.

Under penalties of perjury, I certify that I am entitled to the amount of withholding per pay period claimed on this worksheet.

Date:

__________________________

X

Employee's Signature -

EXAMPLE OF GROSS TAX LIABILITY CALCULATION:

TAX TABLE

Taxable Income

On Amounts

Between

Pay

Plus

Over

If your Estimated Taxable Income, (Line 8) is $12,000:

$

0 - $ 2,000

$

0.00

0.00%

0

$ 2,000 - $ 5,000

$

0.00

2.20%

$ 2,000

PAY:

$261.00 + {(12,000 - 10,000) X 0.048}

$ 5,000 - $ 10,000

$

66.00

3.90%

$ 5,000

= $261.00 + (2,000 X 0.048)

$ 10,000 - $ 20,000

$

261.00

4.80%

$ 10,000

= $261.00 + 96.00

$ 20,000 - $ 25,000

$

741.00

5.20%

$ 20,000

= $357.00

$ 25,000 - $ 60,000

$ 1,001.00

5.55%

$ 25,000

$ 60,000 & over

$ 2,943.50

5.95%

$ 60,000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2