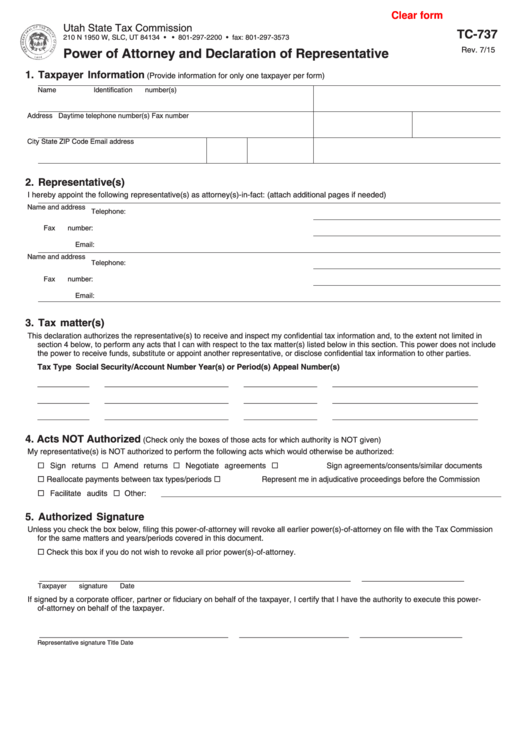

Clear form

Utah State Tax Commission

TC-737

210 N 1950 W, SLC, UT 84134 • tax.utah.gov • 801-297-2200 • fax: 801-297-3573

Rev. 7/15

Power of Attorney and Declaration of Representative

1. Taxpayer Information

(Provide information for only one taxpayer per form)

Name

Identification number(s)

Address

Daytime telephone number(s) Fax number

City

State

ZIP Code

Email address

2. Representative(s)

I hereby appoint the following representative(s) as attorney(s)-in-fact: (attach additional pages if needed)

Name and address

Telephone:

Fax number:

Email:

Name and address

Telephone:

Fax number:

Email:

3. Tax matter(s)

This declaration authorizes the representative(s) to receive and inspect my confidential tax information and, to the extent not limited in

section 4 below, to perform any acts that I can with respect to the tax matter(s) listed below in this section. This power does not include

the power to receive funds, substitute or appoint another representative, or disclose confidential tax information to other parties.

Tax Type

Social Security/Account Number

Year(s) or Period(s)

Appeal Number(s)

_ _ __ _ __

_ _ _ __ ___ ___ __ ___ _

__________

_________________ __ _

_ _ __ _ __

_ _ _ __ ___ ___ __ ___ _

__________

_________________ __ _

_ _ __ _ __

_ _ _ __ ___ ___ __ ___ _

__________

_________________ __ _

4. Acts NOT Authorized

(Check only the boxes of those acts for which authority is NOT given)

My representative(s) is NOT authorized to perform the following acts which would otherwise be authorized:

Sign returns

Amend returns

Negotiate agreements

Sign agreements/consents/similar documents

Reallocate payments between tax types/periods

Represent me in adjudicative proceedings before the Commission

Facilitate audits

Other: ___ __ ___ _________________________________ _ __ __ _

5. Authorized Signature

Unless you check the box below, filing this power-of-attorney will revoke all earlier power(s)-of-attorney on file with the Tax Commission

for the same matters and years/periods covered in this document.

Check this box if you do not wish to revoke all prior power(s)-of-attorney.

_ ___ __ _ __ _ _ __ _ ___ ___ __ ___ __________________

_________ __ __ _

Taxpayer signature

Date

If signed by a corporate officer, partner or fiduciary on behalf of the taxpayer, I certify that I have the authority to execute this power-

of-attorney on behalf of the taxpayer.

_ ___ __ _ __ _ _ __ _ ___ ___ __ ___ _

_______________

__________ __ _ _

Representative signature

Title

Date

1

1