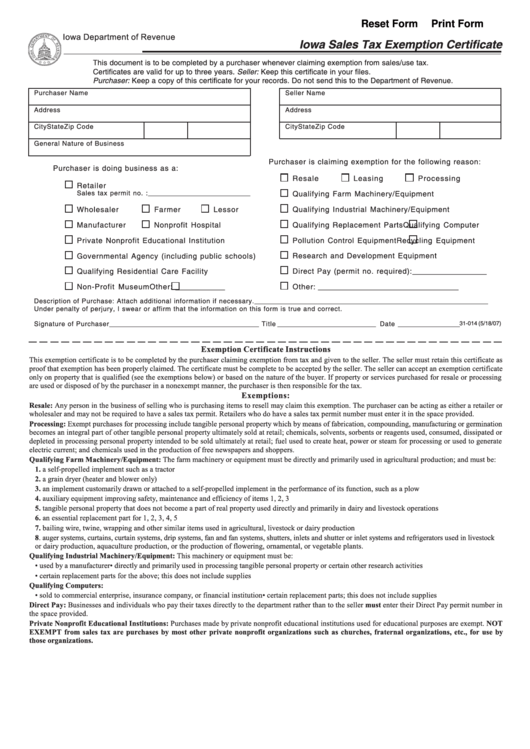

Reset Form

Print Form

Iowa Department of Revenue

Iowa Sales Tax Exemption Certificate

This document is to be completed by a purchaser whenever claiming exemption from sales/use tax.

Certificates are valid for up to three years. Seller: Keep this certificate in your files.

Purchaser: Keep a copy of this certificate for your records. Do not send this to the Department of Revenue.

Purchaser Name

Seller Name

Address

Address

City

State

Zip Code

City

State

Zip Code

General Nature of Business

Purchaser is claiming exemption for the following reason:

Purchaser is doing business as a:

Resale

Leasing

Processing

Retailer

Sales tax permit no. : ____________________________

Qualifying Farm Machinery/Equipment

Qualifying Industrial Machinery/Equipment

Wholesaler

Farmer

Lessor

Qualifying Replacement Parts

Qualifying Computer

Manufacturer

Nonprofit Hospital

Pollution Control Equipment

Recycling Equipment

Private Nonprofit Educational Institution

Governmental Agency (including public schools)

Research and Development Equipment

Qualifying Residential Care Facility

Direct Pay (permit no. required): __________________

Non-Profit Museum

Other: ____________

Other: __________________________________

Description of Purchase: Attach additional information if necessary. ________________________________________________________________

Under penalty of perjury, I swear or affirm that the information on this form is true and correct.

Signature of Purchaser _________________________________________ Title ___________________________ Date _________________

31-014 (5/18/07)

Exemption Certificate Instructions

This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this certificate as

proof that exemption has been properly claimed. The certificate must be complete to be accepted by the seller. The seller can accept an exemption certificate

only on property that is qualified (see the exemptions below) or based on the nature of the buyer. If property or services purchased for resale or processing

are used or disposed of by the purchaser in a nonexempt manner, the purchaser is then responsible for the tax.

Exemptions:

Resale: Any person in the business of selling who is purchasing items to resell may claim this exemption. The purchaser can be acting as either a retailer or

wholesaler and may not be required to have a sales tax permit. Retailers who do have a sales tax permit number must enter it in the space provided.

Processing: Exempt purchases for processing include tangible personal property which by means of fabrication, compounding, manufacturing or germination

becomes an integral part of other tangible personal property ultimately sold at retail; chemicals, solvents, sorbents or reagents used, consumed, dissipated or

depleted in processing personal property intended to be sold ultimately at retail; fuel used to create heat, power or steam for processing or used to generate

electric current; and chemicals used in the production of free newspapers and shoppers.

Qualifying Farm Machinery/Equipment: The farm machinery or equipment must be directly and primarily used in agricultural production; and must be:

1. a self-propelled implement such as a tractor

2. a grain dryer (heater and blower only)

3. an implement customarily drawn or attached to a self-propelled implement in the performance of its function, such as a plow

4. auxiliary equipment improving safety, maintenance and efficiency of items 1, 2, 3

5. tangible personal property that does not become a part of real property used directly and primarily in dairy and livestock operations

6. an essential replacement part for 1, 2, 3, 4, 5

7. bailing wire, twine, wrapping and other similar items used in agricultural, livestock or dairy production

8. auger systems, curtains, curtain systems, drip systems, fan and fan systems, shutters, inlets and shutter or inlet systems and refrigerators used in

livestock

or dairy production, aquaculture production, or the production of flowering, ornamental, or vegetable plants.

Qualifying Industrial Machinery/Equipment: This machinery or equipment must be:

• used by a manufacturer

• directly and primarily used in processing tangible personal property or certain other research activities

• certain replacement parts for the above; this does not include supplies

Qualifying Computers:

• sold to commercial enterprise, insurance company, or financial institution

• certain replacement parts; this does not include supplies

Direct Pay: Businesses and individuals who pay their taxes directly to the department rather than to the seller must enter their Direct Pay permit number in

the space provided.

Private Nonprofit Educational Institutions: Purchases made by private nonprofit educational institutions used for educational purposes are exempt. NOT

EXEMPT from sales tax are purchases by most other private nonprofit organizations such as churches, fraternal organizations, etc., for use by

those organizations.

1

1