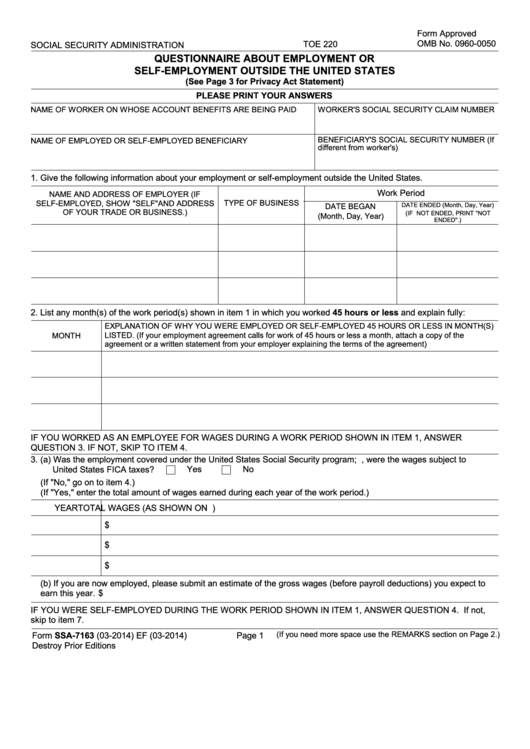

Form Approved

OMB No. 0960-0050

TOE 220

SOCIAL SECURITY ADMINISTRATION

QUESTIONNAIRE ABOUT EMPLOYMENT OR

SELF-EMPLOYMENT OUTSIDE THE UNITED STATES

(See Page 3 for Privacy Act Statement)

PLEASE PRINT YOUR ANSWERS

NAME OF WORKER ON WHOSE ACCOUNT BENEFITS ARE BEING PAID

WORKER'S SOCIAL SECURITY CLAIM NUMBER

BENEFICIARY'S SOCIAL SECURITY NUMBER (If

NAME OF EMPLOYED OR SELF-EMPLOYED BENEFICIARY

different from worker's)

1. Give the following information about your employment or self-employment outside the United States.

Work Period

NAME AND ADDRESS OF EMPLOYER (IF

TYPE OF BUSINESS

SELF-EMPLOYED, SHOW "SELF"AND ADDRESS

DATE BEGAN

DATE ENDED (Month, Day, Year)

OF YOUR TRADE OR BUSINESS.)

(IF NOT ENDED, PRINT "NOT

(Month, Day, Year)

ENDED".)

2. List any month(s) of the work period(s) shown in item 1 in which you worked 45 hours or less and explain fully:

EXPLANATION OF WHY YOU WERE EMPLOYED OR SELF-EMPLOYED 45 HOURS OR LESS IN MONTH(S)

LISTED. (If your employment agreement calls for work of 45 hours or less a month, attach a copy of the

MONTH

agreement or a written statement from your employer explaining the terms of the agreement)

IF YOU WORKED AS AN EMPLOYEE FOR WAGES DURING A WORK PERIOD SHOWN IN ITEM 1, ANSWER

QUESTION 3. IF NOT, SKIP TO ITEM 4.

3. (a) Was the employment covered under the United States Social Security program; i.e., were the wages subject to

United States FICA taxes?

Yes

No

(If "No," go on to item 4.)

(If "Yes," enter the total amount of wages earned during each year of the work period.)

YEAR

TOTAL WAGES (AS SHOWN ON U.S. FORM W-2 BEFORE PAYROLL DEDUCTIONS)

$

$

$

(b) If you are now employed, please submit an estimate of the gross wages (before payroll deductions) you expect to

$

earn this year.

IF YOU WERE SELF-EMPLOYED DURING THE WORK PERIOD SHOWN IN ITEM 1, ANSWER QUESTION 4. If not,

skip to item 7.

(If you need more space use the REMARKS section on Page 2.)

Form SSA-7163 (03-2014) EF (03-2014)

Page 1

Destroy Prior Editions

1

1 2

2 3

3