Instructions For Form 4461-B - Internal Revenue Service

ADVERTISEMENT

2

Form 4461-B (Rev. 8-94)

Page

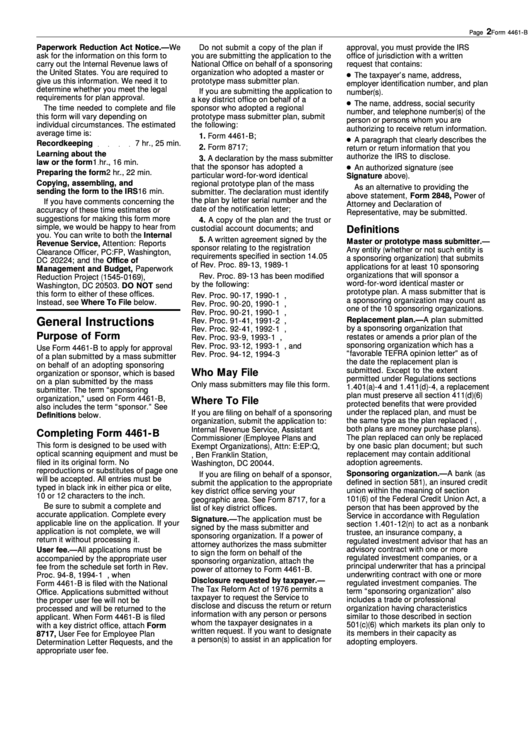

Paperwork Reduction Act Notice.—We

Do not submit a copy of the plan if

approval, you must provide the IRS

ask for the information on this form to

you are submitting the application to the

office of jurisdiction with a written

carry out the Internal Revenue laws of

National Office on behalf of a sponsoring

request that contains:

the United States. You are required to

organization who adopted a master or

The taxpayer’s name, address,

give us this information. We need it to

prototype mass submitter plan.

employer identification number, and plan

determine whether you meet the legal

If you are submitting the application to

number(s).

requirements for plan approval.

a key district office on behalf of a

The name, address, social security

The time needed to complete and file

sponsor who adopted a regional

number, and telephone number(s) of the

this form will vary depending on

prototype mass submitter plan, submit

person or persons whom you are

individual circumstances. The estimated

the following:

authorizing to receive return information.

average time is:

1. Form 4461-B;

A paragraph that clearly describes the

Recordkeeping

7 hr., 25 min.

2. Form 8717;

return or return information that you

Learning about the

authorize the IRS to disclose.

3. A declaration by the mass submitter

law or the form

1 hr., 16 min.

that the sponsor has adopted a

An authorized signature (see

Preparing the form

2 hr., 22 min.

particular word-for-word identical

Signature above).

Copying, assembling, and

regional prototype plan of the mass

As an alternative to providing the

sending the form to the IRS

16 min.

submitter. The declaration must identify

above statement, Form 2848, Power of

the plan by letter serial number and the

If you have comments concerning the

Attorney and Declaration of

date of the notification letter;

accuracy of these time estimates or

Representative, may be submitted.

suggestions for making this form more

4. A copy of the plan and the trust or

simple, we would be happy to hear from

custodial account documents; and

Definitions

you. You can write to both the Internal

5. A written agreement signed by the

Master or prototype mass submitter.—

Revenue Service, Attention: Reports

sponsor relating to the registration

Any entity (whether or not such entity is

Clearance Officer, PC:FP, Washington,

requirements specified in section 14.05

a sponsoring organization) that submits

DC 20224; and the Office of

of Rev. Proc. 89-13, 1989-1 C.B. 801.

applications for at least 10 sponsoring

Management and Budget, Paperwork

organizations that will sponsor a

Rev. Proc. 89-13 has been modified

Reduction Project (1545-0169),

word-for-word identical master or

by the following:

Washington, DC 20503. DO NOT send

prototype plan. A mass submitter that is

this form to either of these offices.

Rev. Proc. 90-17, 1990-1 C.B. 497,

a sponsoring organization may count as

Instead, see Where To File below.

Rev. Proc. 90-20, 1990-1 C.B. 495,

one of the 10 sponsoring organizations.

Rev. Proc. 90-21, 1990-1 C.B. 499,

General Instructions

Replacement plan.—A plan submitted

Rev. Proc. 91-41, 1991-2 C.B. 697,

by a sponsoring organization that

Rev. Proc. 92-41, 1992-1 C.B. 870,

Purpose of Form

restates or amends a prior plan of the

Rev. Proc. 93-9, 1993-1 C.B. 474,

sponsoring organization which has a

Rev. Proc. 93-12, 1993-1 C.B. 479, and

Use Form 4461-B to apply for approval

“favorable TEFRA opinion letter” as of

Rev. Proc. 94-12, 1994-3 I.R.B. 18.

of a plan submitted by a mass submitter

the date the replacement plan is

on behalf of an adopting sponsoring

submitted. Except to the extent

Who May File

organization or sponsor, which is based

permitted under Regulations sections

on a plan submitted by the mass

Only mass submitters may file this form.

1.401(a)-4 and 1.411(d)-4, a replacement

submitter. The term “sponsoring

plan must preserve all section 411(d)(6)

organization,” used on Form 4461-B,

Where To File

protected benefits that were provided

also includes the term “sponsor.” See

under the replaced plan, and must be

If you are filing on behalf of a sponsoring

Definitions below.

the same type as the plan replaced (e.g.,

organization, submit the application to:

both plans are money purchase plans).

Internal Revenue Service, Assistant

Completing Form 4461-B

The plan replaced can only be replaced

Commissioner (Employee Plans and

This form is designed to be used with

by one basic plan document; but such

Exempt Organizations), Attn: E:EP:Q,

optical scanning equipment and must be

replacement may contain additional

P.O. Box 14073, Ben Franklin Station,

filed in its original form. No

adoption agreements.

Washington, DC 20044.

reproductions or substitutes of page one

Sponsoring organization.—A bank (as

If you are filing on behalf of a sponsor,

will be accepted. All entries must be

defined in section 581), an insured credit

submit the application to the appropriate

typed in black ink in either pica or elite,

union within the meaning of section

key district office serving your

10 or 12 characters to the inch.

101(6) of the Federal Credit Union Act, a

geographic area. See Form 8717, for a

Be sure to submit a complete and

person that has been approved by the

list of key district offices.

accurate application. Complete every

Service in accordance with Regulation

Signature.—The application must be

applicable line on the application. If your

section 1.401-12(n) to act as a nonbank

signed by the mass submitter and

application is not complete, we will

trustee, an insurance company, a

sponsoring organization. If a power of

return it without processing it.

regulated investment advisor that has an

attorney authorizes the mass submitter

advisory contract with one or more

User fee.—All applications must be

to sign the form on behalf of the

regulated investment companies, or a

accompanied by the appropriate user

sponsoring organization, attach the

principal underwriter that has a principal

fee from the schedule set forth in Rev.

power of attorney to Form 4461-B.

underwriting contract with one or more

Proc. 94-8, 1994-1 I.R.B. 176, when

Disclosure requested by taxpayer.—

regulated investment companies. The

Form 4461-B is filed with the National

The Tax Reform Act of 1976 permits a

term “sponsoring organization” also

Office. Applications submitted without

taxpayer to request the Service to

includes a trade or professional

the proper user fee will not be

disclose and discuss the return or return

organization having characteristics

processed and will be returned to the

information with any person or persons

similar to those described in section

applicant. When Form 4461-B is filed

whom the taxpayer designates in a

501(c)(6) which markets its plan only to

with a key district office, attach Form

written request. If you want to designate

its members in their capacity as

8717, User Fee for Employee Plan

a person(s) to assist in an application for

adopting employers.

Determination Letter Requests, and the

appropriate user fee.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2