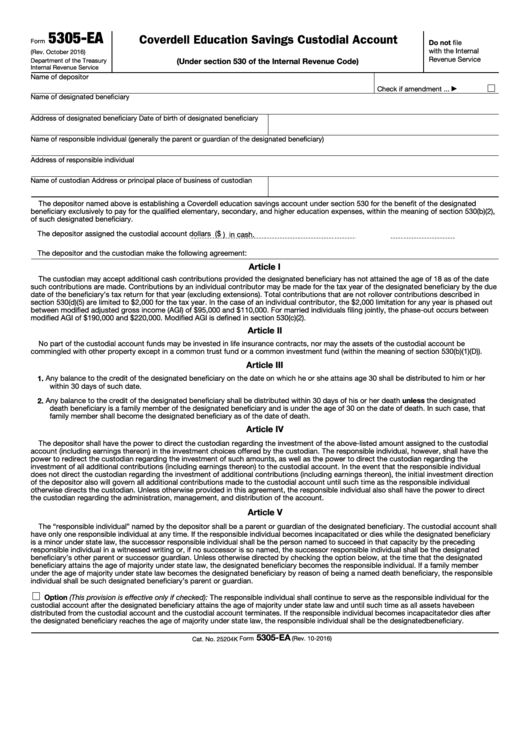

5305-EA

Coverdell Education Savings Custodial Account

Form

Do not file

with the Internal

(Rev. October 2016)

Revenue Service

(Under section 530 of the Internal Revenue Code)

Department of the Treasury

Internal Revenue Service

Name of depositor

Check if amendment .

.

.

▶

Name of designated beneficiary

Address of designated beneficiary

Date of birth of designated beneficiary

Name of responsible individual (generally the parent or guardian of the designated beneficiary)

Address of responsible individual

Name of custodian

Address or principal place of business of custodian

The depositor named above is establishing a Coverdell education savings account under section 530 for the benefit of the designated

beneficiary exclusively to pay for the qualified elementary, secondary, and higher education expenses, within the meaning of section 530(b)(2),

of such designated beneficiary.

The depositor assigned the custodial account

dollars ($

) in cash.

The depositor and the custodian make the following agreement:

Article I

The custodian may accept additional cash contributions provided the designated beneficiary has not attained the age of 18 as of the date

such contributions are made. Contributions by an individual contributor may be made for the tax year of the designated beneficiary by the due

date of the beneficiary’s tax return for that year (excluding extensions). Total contributions that are not rollover contributions described in

section 530(d)(5) are limited to $2,000 for the tax year. In the case of an individual contributor, the $2,000 limitation for any year is phased out

between modified adjusted gross income (AGI) of $95,000 and $110,000. For married individuals filing jointly, the phase-out occurs between

modified AGI of $190,000 and $220,000. Modified AGI is defined in section 530(c)(2).

Article II

No part of the custodial account funds may be invested in life insurance contracts, nor may the assets of the custodial account be

commingled with other property except in a common trust fund or a common investment fund (within the meaning of section 530(b)(1)(D)).

Article III

1. Any balance to the credit of the designated beneficiary on the date on which he or she attains age 30 shall be distributed to him or her

within 30 days of such date.

2. Any balance to the credit of the designated beneficiary shall be distributed within 30 days of his or her death unless the designated

death beneficiary is a family member of the designated beneficiary and is under the age of 30 on the date of death. In such case, that

family member shall become the designated beneficiary as of the date of death.

Article IV

The depositor shall have the power to direct the custodian regarding the investment of the above-listed amount assigned to the custodial

account (including earnings thereon) in the investment choices offered by the custodian. The responsible individual, however, shall have the

power to redirect the custodian regarding the investment of such amounts, as well as the power to direct the custodian regarding the

investment of all additional contributions (including earnings thereon) to the custodial account. In the event that the responsible individual

does not direct the custodian regarding the investment of additional contributions (including earnings thereon), the initial investment direction

of the depositor also will govern all additional contributions made to the custodial account until such time as the responsible individual

otherwise directs the custodian. Unless otherwise provided in this agreement, the responsible individual also shall have the power to direct

the custodian regarding the administration, management, and distribution of the account.

Article V

The “responsible individual” named by the depositor shall be a parent or guardian of the designated beneficiary. The custodial account shall

have only one responsible individual at any time. If the responsible individual becomes incapacitated or dies while the designated beneficiary

is a minor under state law, the successor responsible individual shall be the person named to succeed in that capacity by the preceding

responsible individual in a witnessed writing or, if no successor is so named, the successor responsible individual shall be the designated

beneficiary’s other parent or successor guardian. Unless otherwise directed by checking the option below, at the time that the designated

beneficiary attains the age of majority under state law, the designated beneficiary becomes the responsible individual. If a family member

under the age of majority under state law becomes the designated beneficiary by reason of being a named death beneficiary, the responsible

individual shall be such designated beneficiary’s parent or guardian.

Option (This provision is effective only if checked): The responsible individual shall continue to serve as the responsible individual for the

custodial account after the designated beneficiary attains the age of majority under state law and until such time as all assets have been

distributed from the custodial account and the custodial account terminates. If the responsible individual becomes incapacitated or dies after

the designated beneficiary reaches the age of majority under state law, the responsible individual shall be the designated beneficiary.

5305-EA

Form

(Rev. 10-2016)

Cat. No. 25204K

1

1 2

2