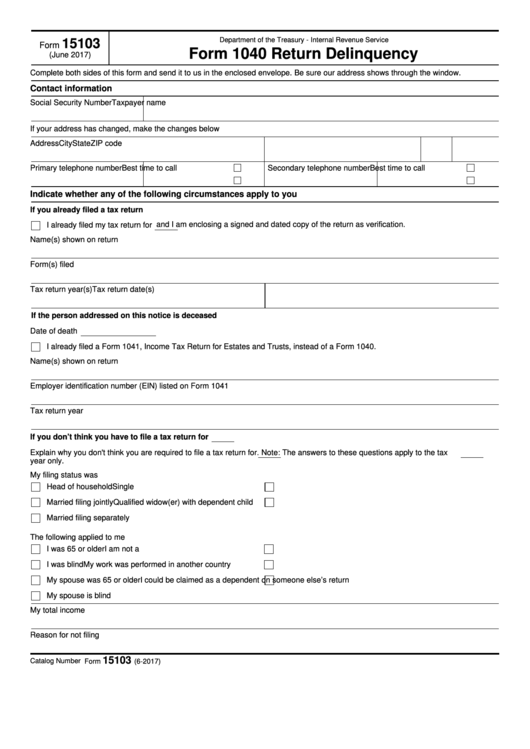

Department of the Treasury - Internal Revenue Service

15103

Form

Form 1040 Return Delinquency

(June 2017)

Complete both sides of this form and send it to us in the enclosed envelope. Be sure our address shows through the window.

Contact information

Social Security Number

Taxpayer name

If your address has changed, make the changes below

Address

City

State

ZIP code

a.m.

a.m.

Primary telephone number

Best time to call

Secondary telephone number

Best time to call

p.m.

p.m.

Indicate whether any of the following circumstances apply to you

If you already filed a tax return

and I am enclosing a signed and dated copy of the return as verification.

I already filed my tax return for

Name(s) shown on return

Form(s) filed

Tax return year(s)

Tax return date(s)

If the person addressed on this notice is deceased

Date of death

I already filed a Form 1041, Income Tax Return for Estates and Trusts, instead of a Form 1040.

Name(s) shown on return

Employer identification number (EIN) listed on Form 1041

Tax return year

If you don’t think you have to file a tax return for

Explain why you don't think you are required to file a tax return for

. Note: The answers to these questions apply to the

tax

year only.

My filing status was

Head of household

Single

Married filing jointly

Qualified widow(er) with dependent child

Married filing separately

The following applied to me

I was 65 or older

I am not a U.S. citizen or permanent resident

I was blind

My work was performed in another country

My spouse was 65 or older

I could be claimed as a dependent on someone else’s return

My spouse is blind

My total income

Reason for not filing

15103

Catalog Number 69797K

Form

(6-2017)

1

1 2

2