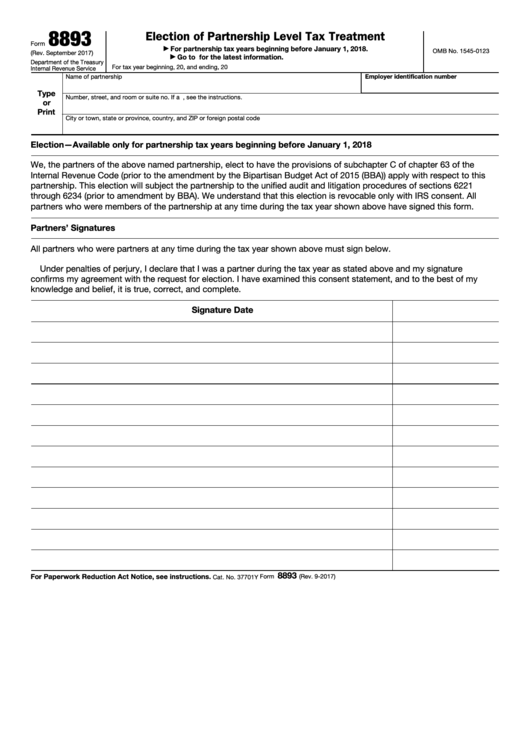

8893

Election of Partnership Level Tax Treatment

Form

For partnership tax years beginning before January 1, 2018.

▶

OMB No. 1545-0123

(Rev. September 2017)

Go to for the latest information.

▶

Department of the Treasury

For tax year beginning

, 20

, and ending

, 20

Internal Revenue Service

Name of partnership

Employer identification number

Type

Number, street, and room or suite no. If a P.O. box, see the instructions.

or

Print

City or town, state or province, country, and ZIP or foreign postal code

Election—Available only for partnership tax years beginning before January 1, 2018

We, the partners of the above named partnership, elect to have the provisions of subchapter C of chapter 63 of the

Internal Revenue Code (prior to the amendment by the Bipartisan Budget Act of 2015 (BBA)) apply with respect to this

partnership. This election will subject the partnership to the unified audit and litigation procedures of sections 6221

through 6234 (prior to amendment by BBA). We understand that this election is revocable only with IRS consent. All

partners who were members of the partnership at any time during the tax year shown above have signed this form.

Partners’ Signatures

All partners who were partners at any time during the tax year shown above must sign below.

Under penalties of perjury, I declare that I was a partner during the tax year as stated above and my signature

confirms my agreement with the request for election. I have examined this consent statement, and to the best of my

knowledge and belief, it is true, correct, and complete.

Signature

Date

8893

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 9-2017)

Cat. No. 37701Y

1

1 2

2