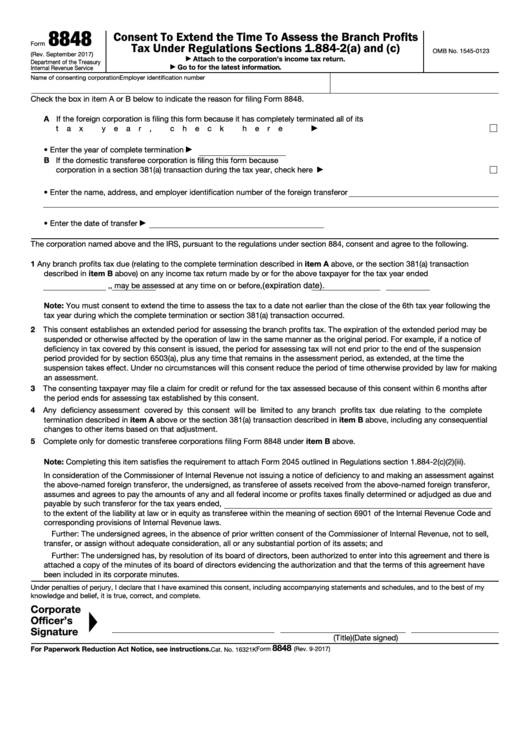

8848

Consent To Extend the Time To Assess the Branch Profits

Form

Tax Under Regulations Sections 1.884-2(a) and (c)

OMB No. 1545-0123

(Rev. September 2017)

Attach to the corporation's income tax return.

▶

Department of the Treasury

Go to for the latest information.

Internal Revenue Service

▶

Name of consenting corporation

Employer identification number

Check the box in item A or B below to indicate the reason for filing Form 8848.

A If the foreign corporation is filing this form because it has completely terminated all of its U.S. trade or business during the

tax year, check here

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

• Enter the year of complete termination

▶

B If the domestic transferee corporation is filing this form because U.S. assets have been transferred to it from a foreign

corporation in a section 381(a) transaction during the tax year, check here

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

• Enter the name, address, and employer identification number of the foreign transferor

• Enter the date of transfer

▶

The corporation named above and the IRS, pursuant to the regulations under section 884, consent and agree to the following.

1 Any branch profits tax due (relating to the complete termination described in item A above, or the section 381(a) transaction

described in item B above) on any income tax return made by or for the above taxpayer for the tax year ended

(expiration date).

,

, may be assessed at any time on or before

,

Note: You must consent to extend the time to assess the tax to a date not earlier than the close of the 6th tax year following the

tax year during which the complete termination or section 381(a) transaction occurred.

2 This consent establishes an extended period for assessing the branch profits tax. The expiration of the extended period may be

suspended or otherwise affected by the operation of law in the same manner as the original period. For example, if a notice of

deficiency in tax covered by this consent is issued, the period for assessing tax will not end prior to the end of the suspension

period provided for by section 6503(a), plus any time that remains in the assessment period, as extended, at the time the

suspension takes effect. Under no circumstances will this consent reduce the period of time otherwise provided by law for making

an assessment.

3 The consenting taxpayer may file a claim for credit or refund for the tax assessed because of this consent within 6 months after

the period ends for assessing tax established by this consent.

4 Any deficiency assessment covered by this consent will be limited to any branch profits tax due relating to the complete

termination described in item A above or the section 381(a) transaction described in item B above, including any consequential

changes to other items based on that adjustment.

5 Complete only for domestic transferee corporations filing Form 8848 under item B above.

Note: Completing this item satisfies the requirement to attach Form 2045 outlined in Regulations section 1.884-2(c)(2)(iii).

In consideration of the Commissioner of Internal Revenue not issuing a notice of deficiency to and making an assessment against

the above-named foreign transferor, the undersigned, as transferee of assets received from the above-named foreign transferor,

assumes and agrees to pay the amounts of any and all federal income or profits taxes finally determined or adjudged as due and

payable by such transferor for the tax years ended

,

to the extent of the liability at law or in equity as transferee within the meaning of section 6901 of the Internal Revenue Code and

corresponding provisions of Internal Revenue laws.

Further: The undersigned agrees, in the absence of prior written consent of the Commissioner of Internal Revenue, not to sell,

transfer, or assign without adequate consideration, all or any substantial portion of its assets; and

Further: The undersigned has, by resolution of its board of directors, been authorized to enter into this agreement and there is

attached a copy of the minutes of its board of directors evidencing the authorization and that the terms of this agreement have

been included in its corporate minutes.

Under penalties of perjury, I declare that I have examined this consent, including accompanying statements and schedules, and to the best of my

knowledge and belief, it is true, correct, and complete.

Corporate

▶

Officer’s

Signature

(Title)

(Date signed)

8848

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 9-2017)

Cat. No. 16321K

1

1 2

2