Determination Under Section 860(E)(4) By A Qualified Investment Entity

ADVERTISEMENT

8927

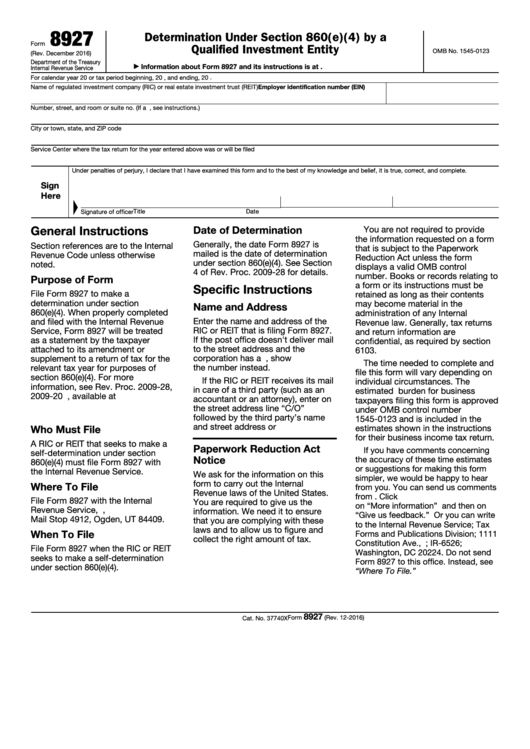

Determination Under Section 860(e)(4) by a

Form

Qualified Investment Entity

OMB No. 1545-0123

(Rev. December 2016)

Department of the Treasury

Information about Form 8927 and its instructions is at

▶

Internal Revenue Service

.

For calendar year 20

or tax period beginning

, 20

, and ending

, 20

Employer identification number (EIN)

Name of regulated investment company (RIC) or real estate investment trust (REIT)

Number, street, and room or suite no. (If a P.O. box, see instructions.)

City or town, state, and ZIP code

Service Center where the tax return for the year entered above was or will be filed

Under penalties of perjury, I declare that I have examined this form and to the best of my knowledge and belief, it is true, correct, and complete.

Sign

Here

Title

Date

Signature of officer

General Instructions

Date of Determination

You are not required to provide

the information requested on a form

Generally, the date Form 8927 is

Section references are to the Internal

that is subject to the Paperwork

mailed is the date of determination

Revenue Code unless otherwise

Reduction Act unless the form

under section 860(e)(4). See Section

noted.

displays a valid OMB control

4 of Rev. Proc. 2009-28 for details.

number. Books or records relating to

Purpose of Form

a form or its instructions must be

Specific Instructions

File Form 8927 to make a

retained as long as their contents

determination under section

may become material in the

Name and Address

860(e)(4). When properly completed

administration of any Internal

Enter the name and address of the

and filed with the Internal Revenue

Revenue law. Generally, tax returns

RIC or REIT that is filing Form 8927.

Service, Form 8927 will be treated

and return information are

If the post office doesn't deliver mail

as a statement by the taxpayer

confidential, as required by section

to the street address and the

attached to its amendment or

6103.

corporation has a P.O. box, show

supplement to a return of tax for the

The time needed to complete and

the number instead.

relevant tax year for purposes of

file this form will vary depending on

section 860(e)(4). For more

If the RIC or REIT receives its mail

individual circumstances. The

information, see Rev. Proc. 2009-28,

in care of a third party (such as an

estimated burden for business

2009-20 I.R.B. 1011, available at

accountant or an attorney), enter on

taxpayers filing this form is approved

the street address line “C/O”

under OMB control number

ar11.html.

followed by the third party’s name

1545-0123 and is included in the

and street address or P.O. box.

Who Must File

estimates shown in the instructions

for their business income tax return.

A RIC or REIT that seeks to make a

Paperwork Reduction Act

If you have comments concerning

self-determination under section

Notice

the accuracy of these time estimates

860(e)(4) must file Form 8927 with

or suggestions for making this form

the Internal Revenue Service.

We ask for the information on this

simpler, we would be happy to hear

form to carry out the Internal

Where To File

from you. You can send us comments

Revenue laws of the United States.

from Click

File Form 8927 with the Internal

You are required to give us the

on “More information” and then on

Revenue Service, P.O. Box 9941,

information. We need it to ensure

“Give us feedback.” Or you can write

Mail Stop 4912, Ogden, UT 84409.

that you are complying with these

to the Internal Revenue Service; Tax

laws and to allow us to figure and

When To File

Forms and Publications Division; 1111

collect the right amount of tax.

Constitution Ave., N.W.; IR-6526;

File Form 8927 when the RIC or REIT

Washington, DC 20224. Do not send

seeks to make a self-determination

Form 8927 to this office. Instead, see

under section 860(e)(4).

“Where To File.”

8927

Form

(Rev. 12-2016)

Cat. No. 37740X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1