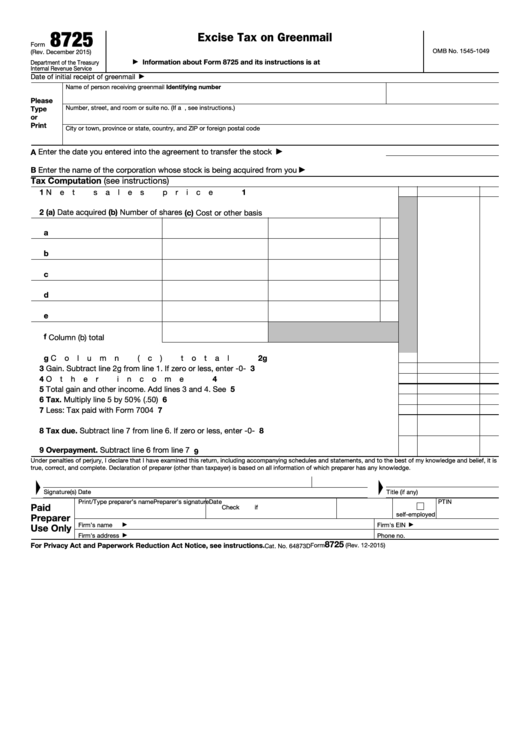

8725

Excise Tax on Greenmail

Form

OMB No. 1545-1049

(Rev. December 2015)

Information about Form 8725 and its instructions is at

Department of the Treasury

▶

Internal Revenue Service

Date of initial receipt of greenmail

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

Identifying number

Name of person receiving greenmail

Please

Number, street, and room or suite no. (If a P.O. box, see instructions.)

Type

or

Print

City or town, province or state, country, and ZIP or foreign postal code

A

Enter the date you entered into the agreement to transfer the stock

.

.

.

.

.

.

.

.

▶

B

Enter the name of the corporation whose stock is being acquired from you

▶

Tax Computation (see instructions)

1

1

Net sales price .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

(a) Date acquired

(b) Number of shares

(c) Cost or other basis

a

b

c

d

e

f

Column (b) total .

.

.

.

g Column (c) total .

2g

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Gain. Subtract line 2g from line 1. If zero or less, enter -0- .

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Other income

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

5

Total gain and other income. Add lines 3 and 4. See instructions .

.

.

.

.

.

.

.

.

.

.

6

Tax. Multiply line 5 by 50% (.50)

6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Less: Tax paid with Form 7004 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Tax due. Subtract line 7 from line 6. If zero or less, enter -0- .

8

.

.

.

.

.

.

.

.

.

.

.

9

Overpayment. Subtract line 6 from line 7

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature(s)

Date

Title (if any)

Print/Type preparer’s name

Preparer's signature

Date

PTIN

Paid

Check

if

self-employed

Preparer

Firm’s name

Firm's EIN

Use Only

▶

▶

Firm's address

Phone no.

▶

8725

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2015)

Cat. No. 64873D

1

1 2

2 3

3