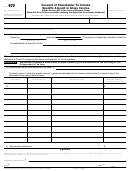

2

Form 972 (Rev. 12-2016)

Page

General Instructions

shareholder agrees to a consent

information. We need it to ensure

dividend and sends a completed

that you are complying with these

Purpose of form. Form 972 is used

Form 972 to the corporation. The

laws and to allow us to figure and

by a shareholder who agrees to

corporation claims the consent

collect the right amount of tax.

report a consent dividend as taxable

dividend deduction on its tax return

You are not required to provide

income in the form of a dividend on

for the fiscal year ending on June

the information requested on a form

the shareholder’s own tax return

30, 2017. The shareholder reports

that is subject to the Paperwork

even though the shareholder

the consent dividend as a taxable

Reduction Act unless the form

receives no actual cash distribution

dividend on its tax return filed for

displays a valid OMB control

of the consented amounts. A

the calendar year ending on

number. Books or records relating to

dividend is a consent dividend only

December 31, 2017.

a form or its instructions must be

if it would have been included in the

Identifying number. Individuals

retained as long as their contents

shareholder’s gross income if it was

enter their social security number.

may become material in the

actually paid. If the shareholder

All others enter their employer

administration of any Internal

agrees to treat the dividend as

identification number.

Revenue law. Generally, tax returns

taxable, the corporation may be able

and return information are

Address. Include the room, suite, or

to claim a consent dividend

confidential, as required by section

other unit number after the street

deduction on its income tax return.

6103.

address. If the Post Office doesn't

Also, the shareholder increases its

deliver mail to the street address

The time needed to complete and

basis in the stock of that corporation

and the shareholder has a P.O. box,

file this form will vary depending on

in the amount of the consent

show the box number instead of the

individual circumstances. The

dividend for which the shareholder is

street address.

estimated burden for individuals is

taxed.

approved under OMB control

Signature. Form 972 must be

Who may file. A shareholder who

number 1545-0074, the estimated

signed by the shareholder. If the

agrees to treat the consent dividend

burden for businesses is approved

shareholder is a partnership, one of

as a taxable dividend must complete

under OMB number 1545-0123, and

the partners must sign. If the

and send Form 972 to the

the estimated burden for all others

shareholder is an estate or trust, the

corporation that will claim the

who file this form is shown below.

fiduciary or officer representing the

consent dividend as a deduction.

estate or trust must sign. For a

Recordkeeping . . 3 hrs., 35 min.

When and where to file. Send the

corporate shareholder, the

Learning about the

completed Form 972 to the

president, vice president, treasurer,

law or the form . . . . . 6 min.

corporation by the due date of the

assistant treasurer, chief accounting

corporation’s tax return for the tax

Preparing the form . . . . 9 min.

officer, or other authorized officer

year the corporation will claim the

If you have comments concerning

(such as tax officer) must sign the

consent dividends as a deduction.

the accuracy of these time estimates

consent.

The corporation must attach Form

or suggestions for making this form

The shareholder’s attorney or

973, Corporation Claim for

simpler, we would be happy to hear

agent may sign this consent if he or

Deduction for Consent Dividends,

from you. You can send us

she is specifically authorized by a

and a copy of each completed Form

comments from

power of attorney which, if not

972 to its income tax return.

Click on

previously filed, must accompany

“More information” and then on

Note: The shareholder must report

Form 972.

“Give us feedback.” Or you can write

the consent dividend as a taxable

to Internal Revenue Service, Tax

dividend in the same tax year the

Paperwork Reduction Act

Forms and Publications Division,

corporation will claim the consent

Notice

1111 Constitution Ave. NW, IR-6526,

dividend deduction. For example,

Washington, DC 20224.

the corporation has a fiscal tax year

We ask for the information on this

that begins on July 1, 2016, and

Do not send the tax form to this

form to carry out the Internal

ends on June 30, 2017. In

office. Instead, see When and where

Revenue laws of the United States.

November 2016, a calendar year

to file on this page.

You are required to give us the

1

1 2

2