Page 2 of 8

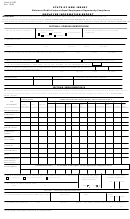

Tribal Entity Reviewed

Employer Identification Number (EIN)

Name of Entity

Address

City

State

Zip

Activity of Entity

Year Entity Started

Performs Services for the Tribe in the Area of

Which of the following tax issues are applicable to the entity:

YES NO

Tax Issues Present

Employment Tax (Withholding and FICA)

Information Reporting (Forms 1099)

Tip Income (do employees of the entity receive tip income)

Title 31 (Bank Secrecy Act compliance)

Natural Resources (Fishing and Land based income exclusions)

Excise Tax (Wagering)

Excise Tax (Other)

Employee Plans (pension and 401k plans) (are employees of the entity covered by an employee

retirement or income deferral plan)

Exempt Organizations (is the entity structured as a not-for-profit organization under Section 501

of the Internal Revenue Code)

Tax Exempt Bonds (does the entity have any outstanding obligations for tax exempt bonds issued)

Is the Entity presently required to file:

YES

NO

Form

Form Description

Form 940

Employer’s Annual Federal Unemployment (FUTA) Tax Return

Form 941

Employer’s Quarterly Federal Tax Return

Employer’s Annual Return – Agricultural Employees

Form 943

Annual Return of Withheld Federal Income Tax

Form 945

Form 990

Return of Exempt Organization

Partnership Tax Return

Form 1065

Form 1120

Corporation Income Tax Return

Form 720

Quarterly Federal Excise Tax Return

Monthly Tax on Wagering

Form 730

Form 11-C

Occupational Tax and Registration Return for Wagering

Form 1042

Annual Withholding Return for U.S. Source Income of Foreign Persons

Highway Use Tax Return

Form 2290

Fiduciary Tax Return

Form 1041

Wage and Tax Statement

Form W-2

Form W-2G

Certain Gambling Winnings

Form 8027

Employer’s Annual Return of Tip Income and Allocated Tips

Form 1098-T

Tuition Statement

Form 1099-MISC

Statement for Recipients of Miscellaneous Income

Form 1099-R

Distributions from Retirement, Insurance, or Profit Sharing Plans

Form 8300

Cash Transactions Over $10,000 Received in a Trade or Business

FinCEN Form 102

Suspicious Activity Report by Casinos and Card Clubs

FinCEN Form 103

Currency Transaction Report by Casinos

13797

Catalog Number 48503Y

Form

(11-2006)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8