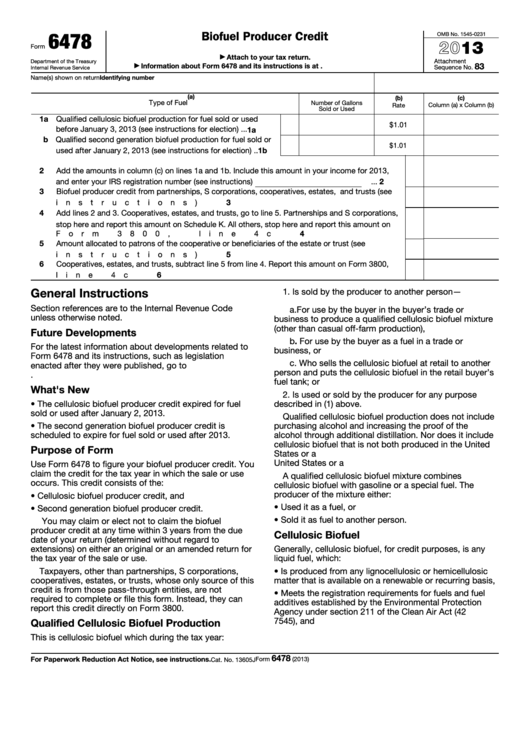

6478

Biofuel Producer Credit

OMB No. 1545-0231

2013

Form

Attach to your tax return.

▶

Attachment

Department of the Treasury

83

Information about Form 6478 and its instructions is at

▶

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

(a)

(c)

(b)

Type of Fuel

Number of Gallons

Column (a) x Column (b)

Rate

Sold or Used

1a Qualified cellulosic biofuel production for fuel sold or used

$1.01

before January 3, 2013 (see instructions for election)

.

.

.

1a

b Qualified second generation biofuel production for fuel sold or

$1.01

used after January 2, 2013 (see instructions for election)

.

.

1b

2

Add the amounts in column (c) on lines 1a and 1b. Include this amount in your income for 2013,

2

and enter your IRS registration number (see instructions)

.

.

.

3

Biofuel producer credit from partnerships, S corporations, cooperatives, estates, and trusts (see

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Add lines 2 and 3. Cooperatives, estates, and trusts, go to line 5. Partnerships and S corporations,

stop here and report this amount on Schedule K. All others, stop here and report this amount on

Form 3800, line 4c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5

Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust (see

5

instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Cooperatives, estates, and trusts, subtract line 5 from line 4. Report this amount on Form 3800,

line 4c .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

General Instructions

1. Is sold by the producer to another person—

Section references are to the Internal Revenue Code

a. For use by the buyer in the buyer’s trade or

unless otherwise noted.

business to produce a qualified cellulosic biofuel mixture

(other than casual off-farm production),

Future Developments

b. For use by the buyer as a fuel in a trade or

For the latest information about developments related to

business, or

Form 6478 and its instructions, such as legislation

c. Who sells the cellulosic biofuel at retail to another

enacted after they were published, go to

person and puts the cellulosic biofuel in the retail buyer’s

fuel tank; or

What's New

2. Is used or sold by the producer for any purpose

• The cellulosic biofuel producer credit expired for fuel

described in (1) above.

sold or used after January 2, 2013.

Qualified cellulosic biofuel production does not include

• The second generation biofuel producer credit is

purchasing alcohol and increasing the proof of the

scheduled to expire for fuel sold or used after 2013.

alcohol through additional distillation. Nor does it include

cellulosic biofuel that is not both produced in the United

Purpose of Form

States or a U.S. possession and used as a fuel in the

United States or a U.S. possession.

Use Form 6478 to figure your biofuel producer credit. You

claim the credit for the tax year in which the sale or use

A qualified cellulosic biofuel mixture combines

occurs. This credit consists of the:

cellulosic biofuel with gasoline or a special fuel. The

producer of the mixture either:

• Cellulosic biofuel producer credit, and

• Used it as a fuel, or

• Second generation biofuel producer credit.

• Sold it as fuel to another person.

You may claim or elect not to claim the biofuel

producer credit at any time within 3 years from the due

Cellulosic Biofuel

date of your return (determined without regard to

extensions) on either an original or an amended return for

Generally, cellulosic biofuel, for credit purposes, is any

the tax year of the sale or use.

liquid fuel, which:

Taxpayers, other than partnerships, S corporations,

• Is produced from any lignocellulosic or hemicellulosic

cooperatives, estates, or trusts, whose only source of this

matter that is available on a renewable or recurring basis,

credit is from those pass-through entities, are not

• Meets the registration requirements for fuels and fuel

required to complete or file this form. Instead, they can

additives established by the Environmental Protection

report this credit directly on Form 3800.

Agency under section 211 of the Clean Air Act (42 U.S.C.

7545), and

Qualified Cellulosic Biofuel Production

This is cellulosic biofuel which during the tax year:

6478

For Paperwork Reduction Act Notice, see instructions.

Form

(2013)

Cat. No. 13605J

1

1 2

2 3

3