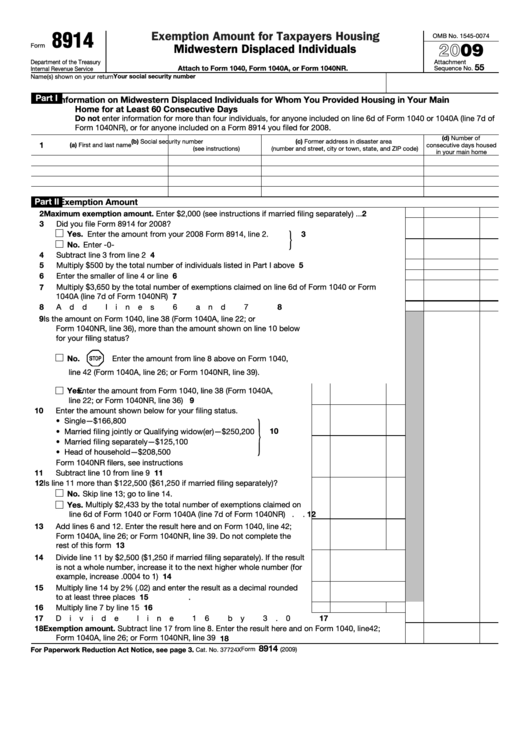

8914

Exemption Amount for Taxpayers Housing

OMB No. 1545-0074

2009

Form

Midwestern Displaced Individuals

Department of the Treasury

Attachment

55

Attach to Form 1040, Form 1040A, or Form 1040NR.

Sequence No.

Internal Revenue Service

Your social security number

Name(s) shown on your return

Part I

Information on Midwestern Displaced Individuals for Whom You Provided Housing in Your Main

Home for at Least 60 Consecutive Days

Do not enter information for more than four individuals, for anyone included on line 6d of Form 1040 or 1040A (line 7d of

Form 1040NR), or for anyone included on a Form 8914 you filed for 2008.

(d) Number of

(b) Social security number

(c) Former address in disaster area

1

(a) First and last name

consecutive days housed

(see instructions)

(number and street, city or town, state, and ZIP code)

in your main home

Part II

Exemption Amount

2

Maximum exemption amount. Enter $2,000 (see instructions if married filing separately)

.

.

.

2

3

Did you file Form 8914 for 2008?

Yes. Enter the amount from your 2008 Form 8914, line 2.

3

}

.

.

.

.

.

.

.

.

.

.

No. Enter -0-

4

4

Subtract line 3 from line 2

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

5

Multiply $500 by the total number of individuals listed in Part I above .

.

.

.

.

.

.

.

.

.

6

Enter the smaller of line 4 or line 5 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

Multiply $3,650 by the total number of exemptions claimed on line 6d of Form 1040 or Form

7

1040A (line 7d of Form 1040NR)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

Add lines 6 and 7 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

Is the amount on Form 1040, line 38 (Form 1040A, line 22; or

Form 1040NR, line 36), more than the amount shown on line 10 below

for your filing status?

No.

Enter the amount from line 8 above on Form 1040,

line 42 (Form 1040A, line 26; or Form 1040NR, line 39).

Yes. Enter the amount from Form 1040, line 38 (Form 1040A,

9

line 22; or Form 1040NR, line 36) .

.

.

.

.

.

.

.

.

.

.

.

10

Enter the amount shown below for your filing status.

• Single—$166,800

}

10

• Married filing jointly or Qualifying widow(er)—$250,200

.

.

.

.

• Married filing separately—$125,100

• Head of household—$208,500

Form 1040NR filers, see instructions

11

11

Subtract line 10 from line 9 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

Is line 11 more than $122,500 ($61,250 if married filing separately)?

No. Skip line 13; go to line 14.

Yes. Multiply $2,433 by the total number of exemptions claimed on

line 6d of Form 1040 or Form 1040A (line 7d of Form 1040NR) .

.

12

13

Add lines 6 and 12. Enter the result here and on Form 1040, line 42;

Form 1040A, line 26; or Form 1040NR, line 39. Do not complete the

rest of this form .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

14

Divide line 11 by $2,500 ($1,250 if married filing separately). If the result

is not a whole number, increase it to the next higher whole number (for

example, increase .0004 to 1) .

.

.

.

.

.

.

.

.

.

.

.

.

.

14

15

Multiply line 14 by 2% (.02) and enter the result as a decimal rounded

.

15

to at least three places

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

16

Multiply line 7 by line 15 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

Divide line 16 by 3.0

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

18

Exemption amount. Subtract line 17 from line 8. Enter the result here and on Form 1040, line 42;

Form 1040A, line 26; or Form 1040NR, line 39 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

18

8914

For Paperwork Reduction Act Notice, see page 3.

Form

(2009)

Cat. No. 37724X

1

1 2

2 3

3 4

4