SS-16

Certificate of Election of Coverage

Send Copies A, B,

Form

and C to the

(Rev. April 2010)

Under the Federal Insurance Contributions Act

appropriate IRS

Department of the Treasury

address on Copy A.

(For use by religious orders whose members are required to take a vow of poverty)

Internal Revenue Service

Full name of religious order (or autonomous subdivision of religious order)

Employer identification number

Address (include number, street, apt., or suite no.)

Effective date (mm/dd/yyyy)

(See instructions on Copy C.)

City, town or post office, state, and ZIP code (If you have a foreign address, see instructions on Copy C.)

Under penalties of perjury, I certify that the religious order named above irrevocably elects social security and Medicare coverage for services performed by all our

current and future members in exercising their required duties (which shall be considered services performed as employees of the religious order) and that our

members are required to take a vow of poverty. Each member’s wages, on which we shall pay the social security and Medicare taxes imposed on employees and

employers, will be determined as provided in section 3121(i)(4) of the Internal Revenue Code.

Sign

(Signature of authorized official)

(Title)

(Date)

here

(Print or type name of authorized official)

(Telephone number)

Future quarter. If Form SS-16 is made

Specific Instructions—

How To File

effective the first day of the calendar quarter

Forms 941 and 941-X

Forms 941 for retroactive quarters. Enter

immediately after the calendar quarter in

“Form SS-16” and the date you filed Form

which Form SS-16 is filed, then Form 941 is

Which Form To File

SS-16 in dark, bold letters across the top

due the last day of the calendar month

margin of page 1 of each Form 941 being

following the calendar quarter.

For the current and future quarters, the taxes

filed. Attach a copy of Form SS-16 to each

are reported on Form 941, Employer’s

Retroactive quarters. Under section 3121(r),

Form 941 filed for a retroactive quarter to

QUARTERLY Federal Tax Return.

the due date of Forms 941 or 941-X for all

help identify that the return is being filed for

retroactive quarters is determined by the date

Form 941. The form that must be filed for

retroactive coverage. In the top margin of the

Form SS-16 is filed. The due date for filing

each of the retroactive quarters depends on

Form SS-16 being attached, enter “Copy” in

the returns and paying the tax, for calendar

whether an original Form 941 was filed for the

dark, bold letters.

quarters prior to the quarter in which Form

specific retroactive period. If Form 941 was

You can get Forms 941 for the retroactive

SS-16 is filed, is the last day of the calendar

never filed for one or more quarters for which

quarters by phone, mail, or on the Internet.

month following the calendar quarter in which

this election is effective, the religious order (or

Order prior-year forms and instructions by

Form SS-16 is filed. If you file and pay by the

subdivision) must file Forms 941 for those

calling 1-800-829-3676. You should receive

applicable due date, you will not be subject

retroactive quarters.

your order within 10 days.

to failure to file or failure to pay penalties or

Form 941-X. If original Forms 941 were filed

interest.

Send your order to the address below.

for any of the retroactive quarters for which

You should receive a response within 10 days

this election is effective, the religious order

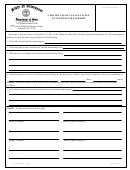

THEN all Forms 941 or

after your request is received.

must file Forms 941-X, Adjusted Employer’s

IF the Form SS-16

941-X for the retroactive

QUARTERLY Federal Tax Return or Claim for

is filed any day

quarters must be filed

Internal Revenue Service

during the . . .

and tax paid by . . .

Refund, for those retroactive quarters.

1201 N. Mitsubishi Motorway

1 st quarter (January,

Bloomington, IL 61705-6613

April 30

Form 944. If you were notified to file Form

February, March)

944, Employer’s ANNUAL Federal Tax Return,

On IRS.gov, click on “Forms and

instead of Form 941, call the IRS for

2 nd quarter (April,

Publications,” then on “Previous years.”

July 31

assistance at 1-800-829-4933 (toll free). If you

May, June)

Select the year and then scroll down to find

have access to TTY/TDD equipment, call

Form 941.

3 rd quarter (July,

October 31

1-800-829-4059 (toll free). If you are in a

Form 941-X. In the explanation in Part IV of

August, September)

foreign country, call 215-516-2000 (not toll

each Form 941-X, enter “Form SS-16” and

free).

4 th quarter (October,

January 31 of next year

the date your Form SS-16 was filed.

November, December)

Additional information. See Pub. 15 (Circular

If you are filing Form 941-X for any

E), Employer’s Tax Guide, for more

retroactive quarter, use the current form. You

information about filing or correcting Form

Postmark rule. For purposes of determining

can get this form through any of the sources

941 or 944. Also see the instructions for Form

when returns are due, generally the “received

listed above.

941, 941-X, or 944.

date” is considered the date Form SS-16 is

Where To File Forms 941 and

filed. However, if the religious order selects an

When To File Forms 941 and

effective date that is the first day of the 20 th

941-X

941-X

calendar quarter preceding the quarter in

See the current instructions for Form 941 or

which Form SS-16 is postmarked but the

Current quarter. If Form SS-16 is made

941-X for the list of filing addresses.

Form SS-16 is received in a later quarter, the

effective the first day of the calendar quarter

IRS will use the postmark date to determine

in which the Form SS-16 is filed, then Form

the date filed to ensure the intended 20 th

941 is due the last day of the calendar month

quarter can be included.

following the calendar quarter.

File in triplicate with Internal Revenue Service

Copy D—Keep for your records

1

1 2

2 3

3 4

4