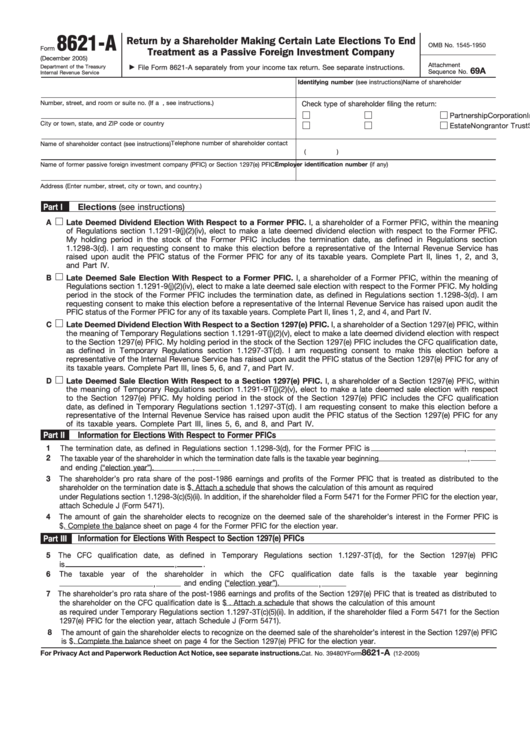

8621-A

Return by a Shareholder Making Certain Late Elections To End

OMB No. 1545-1950

Form

Treatment as a Passive Foreign Investment Company

(December 2005)

Attachment

Department of the Treasury

File Form 8621-A separately from your income tax return. See separate instructions.

69A

Sequence No.

Internal Revenue Service

Name of shareholder

Identifying number (see instructions)

Number, street, and room or suite no. (If a P.O. box, see instructions.)

Check type of shareholder filing the return:

Individual

Corporation

Partnership

City or town, state, and ZIP code or country

S Corporation

Nongrantor Trust

Estate

Telephone number of shareholder contact

Name of shareholder contact (see instructions)

(

)

Name of former passive foreign investment company (PFIC) or Section 1297(e) PFIC

Employer identification number (if any)

Address (Enter number, street, city or town, and country.)

Part I

Elections (see instructions)

A

Late Deemed Dividend Election With Respect to a Former PFIC. I, a shareholder of a Former PFIC, within the meaning

of Regulations section 1.1291-9(j)(2)(iv), elect to make a late deemed dividend election with respect to the Former PFIC.

My holding period in the stock of the Former PFIC includes the termination date, as defined in Regulations section

1.1298-3(d). I am requesting consent to make this election before a representative of the Internal Revenue Service has

raised upon audit the PFIC status of the Former PFIC for any of its taxable years. Complete Part II, lines 1, 2, and 3,

and Part IV.

B

Late Deemed Sale Election With Respect to a Former PFIC. I, a shareholder of a Former PFIC, within the meaning of

Regulations section 1.1291-9(j)(2)(iv), elect to make a late deemed sale election with respect to the Former PFIC. My holding

period in the stock of the Former PFIC includes the termination date, as defined in Regulations section 1.1298-3(d). I am

requesting consent to make this election before a representative of the Internal Revenue Service has raised upon audit the

PFIC status of the Former PFIC for any of its taxable years. Complete Part II, lines 1, 2, and 4, and Part IV.

C

Late Deemed Dividend Election With Respect to a Section 1297(e) PFIC. I, a shareholder of a Section 1297(e) PFIC, within

the meaning of Temporary Regulations section 1.1291-9T(j)(2)(v), elect to make a late deemed dividend election with respect

to the Section 1297(e) PFIC. My holding period in the stock of the Section 1297(e) PFIC includes the CFC qualification date,

as defined in Temporary Regulations section 1.1297-3T(d). I am requesting consent to make this election before a

representative of the Internal Revenue Service has raised upon audit the PFIC status of the Section 1297(e) PFIC for any of

its taxable years. Complete Part III, lines 5, 6, and 7, and Part IV.

Late Deemed Sale Election With Respect to a Section 1297(e) PFIC. I, a shareholder of a Section 1297(e) PFIC, within

D

the meaning of Temporary Regulations section 1.1291-9T(j)(2)(v), elect to make a late deemed sale election with respect

to the Section 1297(e) PFIC. My holding period in the stock of the Section 1297(e) PFIC includes the CFC qualification

date, as defined in Temporary Regulations section 1.1297-3T(d). I am requesting consent to make this election before a

representative of the Internal Revenue Service has raised upon audit the PFIC status of the Section 1297(e) PFIC for any

of its taxable years. Complete Part III, lines 5, 6, and 8, and Part IV.

Part II

Information for Elections With Respect to Former PFICs

1

The termination date, as defined in Regulations section 1.1298-3(d), for the Former PFIC is

,

.

2

,

The taxable year of the shareholder in which the termination date falls is the taxable year beginning

and ending

,

(“election year”).

3

The shareholder’s pro rata share of the post-1986 earnings and profits of the Former PFIC that is treated as distributed to the

shareholder on the termination date is $

. Attach a schedule that shows the calculation of this amount as required

under Regulations section 1.1298-3(c)(5)(ii). In addition, if the shareholder filed a Form 5471 for the Former PFIC for the election year,

attach Schedule J (Form 5471).

4

The amount of gain the shareholder elects to recognize on the deemed sale of the shareholder’s interest in the Former PFIC is

$

. Complete the balance sheet on page 4 for the Former PFIC for the election year.

Information for Elections With Respect to Section 1297(e) PFICs

Part III

5 The CFC qualification date, as defined in Temporary Regulations section 1.1297-3T(d), for the Section 1297(e) PFIC

,

is

.

6

The taxable year of the shareholder in which the CFC qualification date falls is the taxable year beginning

and ending

(“election year”).

,

,

7 The shareholder’s pro rata share of the post-1986 earnings and profits of the Section 1297(e) PFIC that is treated as distributed to

the shareholder on the CFC qualification date is $

. Attach a schedule that shows the calculation of this amount

as required under Temporary Regulations section 1.1297-3T(c)(5)(ii). In addition, if the shareholder filed a Form 5471 for the Section

1297(e) PFIC for the election year, attach Schedule J (Form 5471).

8

The amount of gain the shareholder elects to recognize on the deemed sale of the shareholder’s interest in the Section 1297(e) PFIC

is $

. Complete the balance sheet on page 4 for the Section 1297(e) PFIC for the election year.

8621-A

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 39480Y

Form

(12-2005)

1

1 2

2 3

3 4

4