_____________________________

Account Number

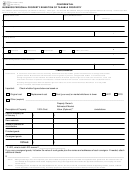

SCHEDULE E: FURNITURE, FIXTURES, MACHINERY, EQUIPMENT, COMPUTERS

Total (by year acquired) all furniture, fixtures, machinery, equipment and computers (new or used) still in possession on Jan. 1. Items received as gifts are

to be listed in the same manner. If needed, attach additional sheets OR a computer generated listing of the information below.

Furniture and Fixtures

Machinery and Equipment

Office Equipment

Good Faith

Good Faith

Good Faith

Historical Cost

Historical Cost

Historical Cost

OR

OR

OR

Year

Estimate of

Year

Estimate of

Year

Estimate of

When New**

When New**

When New**

Acquired

Market Value*

Acquired

Market Value*

Acquired

Market Value*

(Omit Cents)

(Omit Cents)

(Omit Cents)

2016

2016

2016

2015

2015

2015

2014

2014

2014

2013

2013

2013

2012

2012

2012

2011

2011

2011

2010

2010

2010

2009

2009

2009

2008

2008

2008

2007

2007

2007

2006

2006

2006

2005

2005

2005

2004

2004

2004

2003

2003

2003

& Prior

& Prior

& Prior

TOTAL:

TOTAL:

TOTAL:

Computer Equipment

POS/Servers/Mainframes

Other (any other items not listed in other schedules)

Good Faith

Good Faith

Good Faith

Historical Cost

Historical Cost

Historical Cost

OR

OR

OR

Year

Estimate of

Year

Estimate of

Year

Estimate of

When New**

When New**

When New**

Acquired

Market Value*

Acquired

Market Value*

Acquired

Description

Market Value*

(Omit Cents)

(Omit Cents)

(Omit Cents)

2016

2016

2016

2015

2015

2015

2014

2014

2014

2013

2013

2013

2012

2012

2012

2011

2011

2011

2010

2010

2010

2009

2009

2009

2008

2008

2008

& Prior

& Prior

& Prior

TOTAL:

TOTAL:

TOTAL:

SCHEDULE F: PROPERTY UNDER BAILMENT, LEASE, CONSIGNMENT OR OTHER ARRANGEMENT

List the name and address of each owner of taxable property that is in your possession or under your management on Jan. 1 by bailment, lease,

consignment or other arrangement. If needed, attach additional sheets OR a computer-generated copy listing the information below.

Property Owner’s Name

Property Owner’s Address

General Property Description

* If you provide an amount for the good faith estimate of market value, you need not provide historical cost when new and year acquired. Good faith estimate of market value is

not admissible in a subsequent protest, hearing, appeal, suit or other proceeding involving the property except for: (1) proceedings to determine whether a person complied

with rendition requirement; (2) proceedings for determination of fraud or intent to evade tax; or (3) a protest under Tax Code Section 41.41.

** If you provide an amount for historical cost when new and year acquired, you need not provide good faith estimate of market value.

comptroller.texas.gov/taxes/property-tax

Page 3

For more information, visit our website:

50-144 • 11-16/19

1

1 2

2 3

3 4

4 5

5