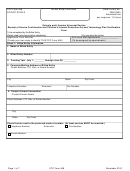

Qualified Plan Certification Form Page 3

Download a blank fillable Qualified Plan Certification Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Qualified Plan Certification Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

The types of compensation are:

l 12b-1 Fees: These fees are charged against the assets of the mutual fund on a continuing basis to compensate broker-dealers, such as Scottrade, for

providing certain distribution and shareholder services. These fees, if applicable, are described in the mutual fund's prospectus and generally range from

0% to 1% of the investment per annum, but Scottrade generally receives .25% per annum.

l Administrative/Shareholder Servicing/Networking Fees: These fees are charged against the assets of the mutual fund on a continuing basis to

compensate broker-dealers, such as Scottrade, for providing certain shareholder services, such as maintaining call centers, keeping shareholder records,

and responding to shareholder requests. These fees, if applicable, are described in the mutual fund's prospectus as "other expenses" and the mutual

fund's Statement of Additional Information. Where applicable, these fees are generally paid to Scottrade quarterly, based on a per fund position.

l Sales and Service Fees: These are fees received by Scottrade from Charles Schwab & Co., Inc. ("Schwab"), Scottrade's mutual fund clearing

intermediary, for distributing mutual fund shares through Schwab's platform. These fees are generally paid by the mutual funds (or an affiliate thereof) to

Schwab, and Schwab passes a portion of these fees to Scottrade.

- For No-Transaction Fee Mutual Funds these fees range from .15% to .30%.

- For Load Funds these fees range from $8 to $12 per position.

Float Income: In general, under ERISA a service provider may retain the benefit of the use of any funds on hand which are incidental to the normal

operation of the plan, and which constitute earnings on funds that are (i) awaiting investment or (ii) transferred to a disbursement account for distribution

from the plan. The DOL has issued guidance that requires financial institutions to make specific disclosures to employee benefit plans, such as your plan,

regarding the circumstances under which the institution has use of, or may derive benefit from, un-invested cash pending investment or distribution

("float"). We may derive benefit from float in connection with providing services to your plan under certain circumstances. Float may be earned by

Scottrade (or an affiliate) until investment or disbursement instructions have been received and the transactions have been executed and settled against

your Account. In general, the amount of float earned is equivalent to the effective Federal Funds rate on the date earned.

Margin: Plan clients having a margin account may grant Scottrade the right, to the extent permitted under applicable law, to hold and re-register collateral

posted by or on behalf of the client, pledge, repledge, hypothecate, rehypothecate, sell, lend or otherwise transfer or use any amount of collateral,

separately or together with other assets or other amount of the collateral, with all attendant rights of ownership (including the right to vote securities), and to

use or invest cash collateral at Scottrade's own benefit and risk. For more information regarding margin accounts, including applicable margin interest

rates, please refer to the "Margin Accounts" section of the Agreement and the Scottrade Margin Agreement.

Additional Disclosures:

- Payment for Order Flow: Scottrade receives compensation for certain equity and option orders as described more completely in our Order

Routing and Execution page on our website. Generally this compensation will take the form of payment for order flow, profit sharing arrangements, liquidity

rebates, or possible trading profits if Scottrade executes the order as principal. Pursuant to SEC Rule 606, we disclose, on a quarterly basis, covered

market venues to which we route customer orders for execution. Our latest report is available at

quality-execution/order-routing.html. In addition, although Scottrade believes it is unable to predict with any meaningful degree of certainty what market

venue, if any, may be used on behalf of a client, the United States market venues listed in our disclosure of Material Aspects of Relationships with Route

Venues (available at ) are provided for general consideration. Clients should

periodically check these websites as Scottrade's relationships with market venues may change over time.

- Gifts, gratuities and non-monetary compensation: From time to time, employees of Scottrade and its affiliates may receive non-monetary

compensation such as gifts and entertainment from vendors with whom they may engage in business dealings on behalf of clients, including ERISA plans.

However, given the nature of Scottrade's businesses, Scottrade reasonably believes that any gifts and entertainment received by its (or its affiliates')

employees are received in the context of a general business relationship and should not be viewed as attributable or allocable to any transactions engaged

in on behalf of their clients, including your plan. Scottrade has historically maintained policies and procedures relating to its gifts and entertainment

activities in response to numerous laws and regulations. Scottrade does not expect to receive gifts with respect to any specific plan or plans in excess of

the de minimis threshold established under the DOL's regulations and guidance.

Recordkeeping Services Required Disclosure: The common understanding of the term "recordkeeping services" is that it covers the keeping of

comprehensive records for the individual participant accounts within a plan, including all contribution, investment and distribution activity, beneficiary

information, and vested status. Scottrade does not provide recordkeeping services as so defined to your plan - that would be the role of a separate

provider, such as a third party administrator.

Account Termination Fee: Scottrade will charge a $75 termination fee or a transfer fee upon termination of the Agreement.

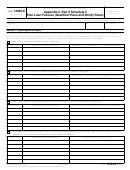

Subcontractors: In providing our brokerage services, we utilize the services of the following subcontractors:

- Charles Schwab & Co., Inc.: Scottrade partners with Schwab to provide custody and clearing services with respect to certain mutual fund

shares held at Scottrade and may receive certain fees and compensation from such mutual fund companies and their affiliates. For Transaction Fee

Funds, Scottrade pays Schwab up to $4 per position. For Load and No-Transaction Fee Funds, Schwab receives certain payments and compensation

from the fund companies (and their affiliates) and has agreed to pass a portion of such compensation to Scottrade, see above.

3-15

Page 3 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3