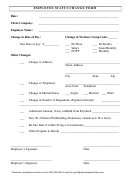

SIMPLE IRA PLAN SALARY REDUCTION AGREEMENT

IMPORTANT: Carefully read all sections of this agreement before signing it.

SECTION A.

GENERAL INFORMATION

Employer and

Name of Employer

Plan Information

Address

City

State

Zip

Employee

Name

Information

Home Address

City

State

Zip

Employee Number

Social Security Number

SECTION B.

TERMS OF AGREEMENT

To Be Completed By the Employer

Limits On

Subject to the requirements of the Employer's SIMPLE IRA Plan, each Employee who is eligible to enroll as a

Elective Deferrals

Contributing Participant may set aside a percentage of his or her pay into the Plan (Elective Deferrals) by signing

this Salary Reduction Agreement. This Salary Reduction Agreement replaces any earlier Salary Reduction

Agreement and will remain in effect as long as the Employee remains an eligible Employee or until he or she

provides the Employer with a new Salary Reduction Agreement as permitted by the Plan. A Participant who is age

50 or older by the end of the Year may be allowed to make Catch-Up Contributions. A Participant's Elective

Deferrals (excluding Catch-Up Contributions) may not exceed $10,000 for 2006; and $10,500 for 2007 (after 2007,

this amount is subject to cost-of-living adjustments).

Changing

An Employee may change the percentage of pay he or she is setting aside into the Plan. Any Employee who wishes

This Agreement

to make such a change must complete and sign a new Salary Reduction Agreement and give it to the Employer

during the Election Period or any other period the Employer specifies on the Participation Notice & Summary

Description.

Terminating

An Employee may terminate this Salary Reduction Agreement. After terminating this Salary Reduction Agreement,

This Agreement

an Employee cannot again enroll as a Contributing Participant until the first day of the Year following the Year of

termination or any other date the Employer specifies on the Participation Notice & Summary Description.

Effective Date

This Salary Reduction Agreement will be effective for the pay period which begins

SECTION C.

AUTHORIZATION

To Be Completed By the Employee

Salary Reduction

I, the undersigned Employee, wish to set aside, as Elective Deferrals,

% or $

(which

Agreement

equals

% of my current rate of pay) into my Employer's SIMPLE IRA Plan by way of payroll

deduction.

NOTE: If you are eligible to defer and you attain age 50 before the close of the Plan Year, you may be able to make

Catch-Up Contributions under the SIMPLE IRA Plan. Certain limits, as required by law, must be met prior to being

eligible to make Catch-Up Contributions. Your election above will pertain to Elective Deferrals which may include

Catch-Up Contributions. See your Employer for additional information, including the Catch-Up Contribution limit for

the Year.

I agree that my pay will be reduced in the manner I have indicated above, and I affirmatively elect to have this

amount contributed to the investments listed below. This Salary Reduction Agreement will continue to be effective

while I am employed, unless I change or terminate it as explained in Section B above. I acknowledge that I have

read this entire Salary Reduction Agreement, I understand it and I agree to its terms. Furthermore, I acknowledge

that I have received a copy of the Participation Notice & Summary Description.

Financial Institution

If contributions are not required to be made to a Designated Financial Institution, provide the name and address of

the financial organization that will serve as the trustee/custodian/issuer for your SIMPLE IRA.

Signatures

Signature of Employee

Authorized Signature for Employer

Date

Title

Date

11-14

1

1 2

2 3

3 4

4