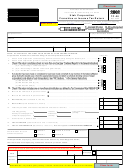

TC-20 A

Rev. 12/05

20052

Schedule A - Computation of Utah Net Taxable Income and Tax Due

Corporation Name

Taxable Year Ending

Employer Identification Number

1. Unadjusted income (loss) before NOL and special deductions (federal form 1120/1120-A) ...........................................

1

00

2. Additions to unadjusted income (Schedule B, line 15) .....................................................................................................

2

00

3. Subtractions from unadjusted income (Schedule C, line 14) ...........................................................................................

3

00

4. Adjusted income (add amounts on lines 1 and 2, then subtract amount on line 3) .........................................................

4

00

5. Nonbusiness income net of related expenses from Schedule H:

a. Allocated to Utah (from Schedule H, line 13) ......................................................

5a

00

b.

Allocated outside Utah (from Schedule H, line 26) .............................................

5b

00

Nonbusiness income total (add lines 5a and 5b) .............................................................................................................

5

00

6. Apportionable income before contributions deduction (subtract line 5 from line 4) .........................................................

6

00

7. Utah contributions (from Schedule D, line 8) ....................................................................................................................

7

00

8. Apportionable income (subtract line 7 from line 6) ..........................................................................................................

8

00

9. Apportionment fraction (enter 100%, or Schedule J, line 7, if applicable) .......................................................................

9

10. Apportioned income (line 8 multiplied by line 9) ..............................................................................................................

10

00

11. Nonbusiness income allocated to Utah (from line 5a above)

.......................................................................................

11

00

12. Utah Taxable Income/Loss (add lines 10 and 11)

..........

12

00

If line 12 is a loss and the election was made to forego the federal

net

operating loss carryback, do you also want to forego the Utah net loss carryback? If an election is not indicated by marking

Yes

No

.....................

a box, it will be assumed the federal election was not made and the Utah loss will be treated as carryback (see instructions).

13. Utah net loss carried forward from prior years (attach documentation)

.........................................................................

13

00

14. Net Taxable Income (subtract line 13 from line 12) ........................................................................................................

14

00

15. Calculation of tax (see instructions)

a. Multiply line 14 by .05 .......................................................................................

15a

00

b.

Minimum tax: $100, or if Schedule M applies, Schedule M, line 5 ....................

15b

00

c.

Enter the greater of 15a or 15b ..........................................................................

15c

00

d. Interest on installment sales and/or recapture of low-income housing credit .....

15d

00

Tax amount (add lines 15c and 15d) ...............................................................................................................................

15

00

16. Nonrefundable Credits (obtain two-digit code from instructions)

CODE

CODE

16a

00

16b

00

The total nonrefundable credits on

16c

00

16d

00

line 16 cannot exceed the amount

on line 15 less line 15(b).

16e

00

16f

00

Total nonrefundable credits (add lines 16a through 16f)

.......................................................................................

16

00

17. Net tax (subtract line 16 from line 15) Cannot be less than line 15b above.

................................................................

17

00

18. Refundable Credits (obtain two-digit code from instructions)

CODE

CODE

18a

00

18b

00

18c

00

18d

00

18e. Total prepayments (Schedule E, line 4) ..............................................................

18e

00

Total refundable credits (add lines 18a through 18e) ..................................................................................................

18

00

19. Amended returns only (see instructions) ......................................................................................................................

19

00

20. Total refundable credits (add lines 18 and 19) ..............................................................................................................

20

00

21. Overpayment - If line 20 is larger than line 17, subtract line 17 from line 20 ...................................................................

21

00

22. Amount of overpayment to be applied as advance payment for next taxable year ..........................................................

22

00

23. Refund - Subtract line 22 from line 21; enter amount here and on TC-20, line 8 ............................................................

23

00

24. Tax Due - If line 17 is larger than line 20, subtract line 20 from line 17; enter amount here and on TC-20, line 9 ..........

24

00

25. Quarterly estimated prepayments meeting exceptions. Check boxes that correspond to the quarterly installments

1st

2nd

3rd

4th

that qualify for exceptions to penalties (see instructions). Attach supporting documentation. ........................................

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2 3

3 4

4 5

5 6

6 7

7