Garnishment Packet - Personal Services (Wage) Continuing Garnishment Page 12

ADVERTISEMENT

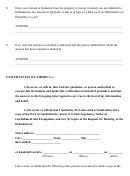

ANSWER Yes ___ No ___

4.

If your answer is yes, figure out, as explained below, the amount of defendant’s pay that

must be held. Assume you are calculating this on the last day of the pay period.

ANSWER

(a)

Gross earnings or income for the pay period during which this writ

was served

$________________

(b)

Less deductions for taxes and other items REQUIRED BY LAW to

be deducted from above amount:

Federal Income Taxes

$_________

FICA

$_________

State Income Taxes

$_________

Other amounts required by law

to be deducted (Identify)

___________________

$_________

(c)

Total of these deductions

$_________

(d)

Disposable earnings or income

(Item (a) minus Item (c))

$_________

(e)

Exempt amount (to be paid to the employee)

Greater of 1, 2 or 3 below

(1)

75% of Defendant's total disposable earnings or income

(Item d):

$__________

(2)

$175.50 times the number of weeks in the pay period:

$__________

(3)

Defendant's disposable income as calculated in item (d)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19