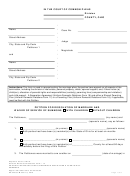

We believe there is good cause not to require immediate income withholding because it

is not in the best interests of the child(ren) for the following reason:

Also, the person paying support agrees to keep the other party (or CSSD if CSSD is

enforcing the order) informed of his/her current employer and the availability of

employment-related health insurance coverage for the child(ren) until the support order is

satisfied.

The person paying support currently receives social security or other disability

compensation that includes regular payments to the child(ren) at least equal to the child

support owed each month. Monthly payment to child(ren): $

.

Source of payment:

Note: To the extent that these payments to the children do not satisfy the monthly amount

owed, the court will order that the remaining amount due be withheld from income.

D. Do you want the assistance of the Child Support Services Division (CSSD) to enforce the

support order and keep records of the payments?

Yes

No

If yes, fill out the attached application for CSSD services. [Note: If the parent with custody of

the children is receiving assistance from the Alaska Temporary Assistance Program (ATAP),

child support payments must be made to CSSD.]

E. Federal Tax Exemption. Under federal tax law, the parent who has physical custody of a child

for the greater part of the year ordinarily has the right to claim the exemption for the child,

unless that parent agrees not to claim the exemption by signing IRS Form 8332 each year.

agrees to sign IRS Form 8332 allowing the

other parent,

, to claim the exemption for the

following child(ren):

in the following years:

The above agreement may be modified without court order if both parties agree in writing and

if permitted by federal tax law.

As required by AS 25.24.232, we agree that the parent who has physical custody of the

child(ren) for a period less than the other parent may not claim the exemption in any tax year if

on December 31 of that year the parent was behind in child support payments in an amount

more than four times the monthly child support obligation.

F. Permanent Fund Dividend. We agree that any applications for the Alaska PFD on behalf of the

children, while they are minors, will be filed by

.

This agreement about the PFD applications may be changed, without court order, if both

parties agree in writing.

VII. SPOUSAL MAINTENANCE (ALIMONY): $

per month to be paid by

Husband

Wife, beginning

until

or until the recipient dies or remarries.

If child support payments will be made through the Child Support Services Division, you may also

have spousal maintenance payments made through CSSD. Do you want spousal maintenance

payments to be made through CSSD?

Yes

No

Husband’s Signature

Wife’s Signature

Page 13 of 15

DR-105 (4/09)(cs)

AS 25.24.200-.260

PETITION FOR DISSOLUTION OF MARRIAGE (WITH CHILDREN)

Civil Rule 90.1(a), f(2)(A)(B), (i)(1)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15