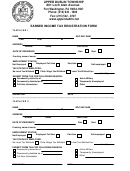

Earnings Garnishment Kansas Court Forms Page 11

ADVERTISEMENT

5. If you are withholding money from the judgment debtor's earnings under an income withholding order,

complete paragraph 10 of the form.

6. If you are withholding money from the judgment debtor's earnings under any other lien which has

priority over garnishments under the law, complete paragraph 11 of the form.

7. Compute the amount of earnings which may be paid to the judgment debtor (your employee) and

complete paragraphs 12, 13 and 14 of the Answer form in accordance with the following table:

A. If the employee's disposable earnings are less than:

$154.50 for a Weekly pay period

$309.00 for a Biweekly pay period

$334.75 for a Semimonthly pay period

$669.50 for a Monthly pay period

Pay the employee as if the employee's pay check were not garnished.

B. If the employee's disposable earnings are:

$154.50 to $206.00 for a Weekly pay period, pay the employee .................$154.50

$309.00 to $412.00 for a Biweekly pay period, pay the employee ...............$309

$334.75 to $446.34 for a Semimonthly pay period, pay the employee......... $334.75

$669.50 to $892.67 for a Monthly pay period, pay the employee .................$669.50

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19