Standby Letter Of Credit Sample Wording

ADVERTISEMENT

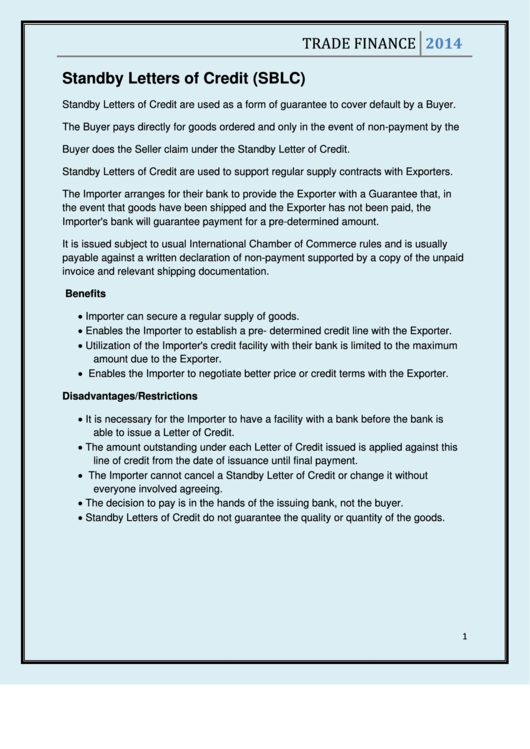

TRADE FINANCE

2014

Standby Letters of Credit (SBLC)

Standby Letters of Credit are used as a form of guarantee to cover default by a Buyer.

The Buyer pays directly for goods ordered and only in the event of non-payment by the

Buyer does the Seller claim under the Standby Letter of Credit.

Standby Letters of Credit are used to support regular supply contracts with Exporters.

The Importer arranges for their bank to provide the Exporter with a Guarantee that, in

the event that goods have been shipped and the Exporter has not been paid, the

Importer's bank will guarantee payment for a pre-determined amount.

It is issued subject to usual International Chamber of Commerce rules and is usually

payable against a written declaration of non-payment supported by a copy of the unpaid

invoice and relevant shipping documentation.

Benefits

Importer can secure a regular supply of goods.

Enables the Importer to establish a pre- determined credit line with the Exporter.

Utilization of the Importer's credit facility with their bank is limited to the maximum

amount due to the Exporter.

Enables the Importer to negotiate better price or credit terms with the Exporter.

Disadvantages/Restrictions

It is necessary for the Importer to have a facility with a bank before the bank is

able to issue a Letter of Credit.

The amount outstanding under each Letter of Credit issued is applied against this

line of credit from the date of issuance until final payment.

The Importer cannot cancel a Standby Letter of Credit or change it without

everyone involved agreeing.

The decision to pay is in the hands of the issuing bank, not the buyer.

Standby Letters of Credit do not guarantee the quality or quantity of the goods.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Letters

1

1 2

2 3

3