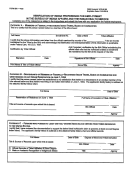

SECTION III

ORIGINATING MATERIALS OR COMPONENTS

Provide the following information for each originating material or component used to produce the good being verified. If none were used, state "NONE".

Name and Address of the Supplier or, if known,

Description of the material or component

Basis of Originating Status

Name & Address of the Manufacturer

Description of the Material or Component:

If the material or component is self-produced (Self-Produced material or component is a material or component that is produced by the producer of a good

and used in the production of that good) and designated as an intermediate material (Intermediate material is a self-produced material or component,

designated by the producer, that meets the rules of origin and that is incorporated into the final good), place the letter 'D' before the name of the material or

component in the table. If the material or component is self-produced but designated as an intermediate material, then each material used in the production

of this self-produced material or component must be identified separately.

Basis of Originating Status:

Describe type of information (i.e. certificate of origin, affidavit, etc.) which was relied upon to determine the originating status of the material or component.

SECTION IV

ADDITIONAL QUESTIONS

1. Has a classification ruling been issued with respect to any of the materials or components produced?

Yes

No

If yes, provide a copy of the ruling.

2. Was the de minimis provision used to determine whether the good being verified was originating?

Yes

No

3. Is the good being verified an originating fungible good?

Yes

No

If yes, check below which inventory management method you used:

LIFO

FIFO

Average

Specific Identification

4. Did any of the originating materials used in the production of the good qualify as an originating fungible material?

Yes

No

If yes, attach a list of the materials that qualify as originating materials under the fungible materials provisions,

and check below which inventory management method you used:

LIFO

FIFO

Average

Specific Identification

5. Was the sale of the good/material to a related person?

Yes

No

6. If a Regional Value Content (RVC) was used in ascertaining whether the good being verified originates,

Transaction

Net Cost

identify the method used.

Value

%

7. What was the estimated qualifying percentage for RVC?

8. Was the RVC calculated using accumulation?

Yes

No

If yes, provide the name and address of each supplier.

SECTION V

CERTIFICATION

I certify that the information on this document is true and accurate and I assume the responsibility for proving such representations. I understand that I am

liable for any false statements or relevant omissions made on or in connection with this document.

Authorized Signature

Company Name (Print or Type)

Name (Print or Type)

Title (Print or Type)

Telephone

Date (MM/DD/YYYY)

PAPERWORK REDUCTION ACT NOTICE: The requested information is needed

The estimated average burden associated with this collection of information

to carry out the terms of the North American Fee Trade Agreement

is 45 minutes per respondent or recordkeeper depending on individual

Implementation Act (NAFTA). NAFTA provides that the CBP administration may

circumstances. Comments concerning the accuracy of this burden estimate

determine by means of a written Implementation Act questionnaire whether a

and suggestions for reducing this burden should be directed to U.S.

good imported into its territory qualifies as an originating good. Failure to provide

Customs and Border Protection, Information Services Branch, Washington

the requested information may result in the loss of preferential tariff treatment

DC 20229, and to the Office of Management and Budget, Paperwork

under the NAFTA.

Reduction Project (1651-0098), Washington, DC 20503.

CBP Form 446 (04/97)

1

1 2

2