2

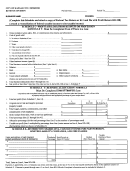

Schedule C (Form 1040) 2015

Page

Part III

Cost of Goods Sold (see instructions)

33

Method(s) used to

a

b

c

value closing inventory:

Cost

Lower of cost or market

Other (attach explanation)

34

Was there any change in determining quantities, costs, or valuations between opening and closing inventory?

Yes

No

If “Yes,” attach explanation .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

35

Inventory at beginning of year. If different from last year’s closing inventory, attach explanation .

.

.

35

36

36

Purchases less cost of items withdrawn for personal use

.

.

.

.

.

.

.

.

.

.

.

.

.

.

37

Cost of labor. Do not include any amounts paid to yourself .

.

.

.

.

.

.

.

.

.

.

.

.

.

37

38

Materials and supplies

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

38

39

Other costs .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

39

40

Add lines 35 through 39 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

40

41

41

Inventory at end of year .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

42

Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 .

.

.

.

.

.

42

Part IV

Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9

and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must

file Form 4562.

/

/

43

When did you place your vehicle in service for business purposes? (month, day, year)

▶

44

Of the total number of miles you drove your vehicle during 2015, enter the number of miles you used your vehicle for:

Business

b Commuting (see instructions)

c Other

a

Yes

No

45

Was your vehicle available for personal use during off-duty hours?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

46

Do you (or your spouse) have another vehicle available for personal use?.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

47a

Do you have evidence to support your deduction? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

b

If “Yes,” is the evidence written?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Part V

Other Expenses. List below business expenses not included on lines 8–26 or line 30.

48

Total other expenses. Enter here and on line 27a .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

48

Schedule C (Form 1040) 2015

1

1 2

2