Instructions For Completing Form SI-350

For faster processing, the required statement for most corporations can be filed online at https://businessfilings.sos.ca.gov.

Every foreign corporation must file a Statement of Information with the California Secretary of State within 90 days after the filing of its

initial Statement and Designation and annually thereafter during the applicable filing period. The applicable filing period for a foreign

corporation is the calendar month during which the initial Statement and Designation by Foreign Corporation was filed and the

immediately preceding five calendar months. A corporation is required to file this statement even though it may not be actively engaged in

business at the time this statement is due. Changes to information contained in a previously filed statement can be made by filing a new

form, completed in its entirety.

Legal Authority: Statutory filing provisions are found in California Corporations Code section 2117, unless otherwise indicated. All

subsequent statutory references are to the California Corporations Code, unless otherwise stated. Failure to file this Statement of

Information by the due date will result in the assessment of a $250.00 penalty. (Section 2206; California Revenue and Taxation Code

section 19141.)

Fees: The Statement of Information must be accompanied by a $20.00 filing fee and $5.00 disclosure fee. The filing fee and the

disclosure fee may be included in a single check made payable to the Secretary of State. All foreign corporations must pay a total of

$25.00 at the time of filing the statement. If this statement is being filed to change any information on a previously filed statement and

is being filed outside the applicable filing period, as defined above, no fee is required.

Copies: To get a copy of the filed statement, include a separate request and payment for copy fees when the statement is submitted.

Copy fees are $1.00 for the first page and $.50 for each additional page. For certified copies, there is an additional $5.00 certification fee,

per copy.

Publicly Traded Foreign Corporations: Every publicly traded foreign corporation also must file a Corporate Disclosure Statement (Form

SI-PT) annually, within 150 days after the end of its fiscal year. A “publicly traded foreign corporation” is a foreign corporation, as defined

in Section 171, that is an issuer as defined in Section 3 of the Securities Exchange Act of 1934, as amended (United States Code, Title

15, section 78c), and has at least one class of securities listed or admitted for trading on a national securities exchange, on the OTC-

Bulletin Board, or on the electronic service operated by Pink OTC Markets Inc. Form SI-PT may be obtained from the Secretary of State’s

website at

or by calling the Statement of Information Unit at (916) 657-5448.

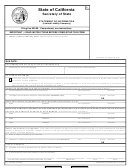

Complete the Statement of Information (Form SI-350) as follows:

Item 1.

Enter the name of the corporation exactly as it is of record with the California Secretary of State.

Item 2.

Enter the corporation number issued by the California Secretary of State.

Item 3.

If there has been no change to the information contained in the last Statement of Information filed with the California Secretary

of State, check the box and proceed to Item 13. Note: A P.O. Box address is not an acceptable address for the agent for

service of process. Therefore, if the last listed address for the agent for service of process is a P.O. Box address, this form

must be completed in its entirety.

If there has been any change to the last Statement of Information filed with the California Secretary of State, including a change

to any address, or no statement has ever been filed, complete this form in its entirety.

Item 4.

Enter the complete street address, city, state and zip code of the principal executive office. Please do not enter a P.O. Box or

abbreviate the name of the city.

Item 5.

Enter the complete street address, city and zip code of the corporation's principal office in California, if any. Please do not enter

a P.O. Box or abbreviate the name of the city. Complete this item only if the address in Item 4 is outside of California.

Item 6.

Enter the mailing address of the corporation, if different from the street address of the principal executive office.

Items

Enter the name and complete business or residential address of the corporation's chief executive officer (i.e., president),

7-9.

secretary and chief financial officer (i.e., treasurer). Please do not abbreviate the name of the city. The corporation must list

these three officers. A comparable title for the specific officer may be added; however, the preprinted titles on this form must not

be altered.

Item 10. Enter the name of the agent for service of process in California. An agent is an individual (director, officer or any other person,

whether or not affiliated with the corporation) who resides in California or another corporation designated to accept service of

process if the corporation is sued. The agent must agree to accept service of process on behalf of the corporation prior to

designation.

If an individual is designated as agent, complete Items 10 and 11. If another corporation is designated as agent, complete Item

10 and proceed to Item 12 (do not complete Item 11).

Note: Before another corporation may be designated as agent, that corporation must have previously filed with the California

Secretary of State, a certificate pursuant to Section 1505.

A corporation cannot act as its own agent and no domestic or

foreign corporation may file pursuant to Section 1505 unless the corporation is currently authorized to engage in business in

California and is in good standing in the records of the California Secretary of State.

Item 11. If an individual is designated as agent for service of process, enter a business or residential street address in California (a P.O.

Box address is not acceptable). Please do not enter “in care of” (c/o) or abbreviate the name of the city. If another corporation

is designated as agent, leave Item 11 blank and proceed to Item 12.

Item 12. Briefly describe the general type of business that constitutes the principal business activity of the corporation.

Item 13. Type or print the name and title of the person completing this form and enter the date this form was completed.

Completed forms along with the applicable fees can be mailed to Secretary of State, Statement of Information Unit, P.O. Box 944230,

Sacramento, CA 94244-2300 or delivered in person (drop off) to the Sacramento office, 1500 11th Street, Sacramento, CA 95814. If you

are not completing this form online, please type or legibly print in black or blue ink. This form must not be altered. This form is filed only in

the Sacramento office.

1

1 2

2 3

3