Instructions For Form 590 -Withholding Exemption Certificate - 2017

ADVERTISEMENT

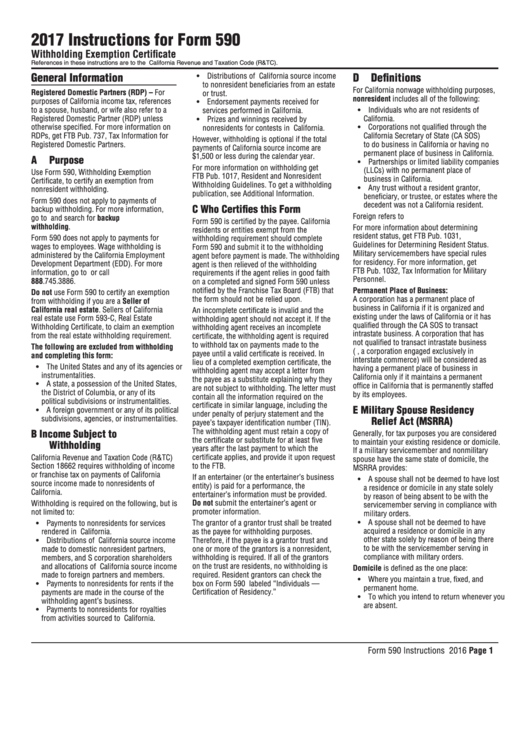

2017 Instructions for Form 590

Withholding Exemption Certificate

References in these instructions are to the California Revenue and Taxation Code (R&TC).

General Information

D

Definitions

• Distributions of California source income

to nonresident beneficiaries from an estate

For California nonwage withholding purposes,

Registered Domestic Partners (RDP) – For

or trust.

nonresident includes all of the following:

purposes of California income tax, references

• Endorsement payments received for

to a spouse, husband, or wife also refer to a

• Individuals who are not residents of

services performed in California.

Registered Domestic Partner (RDP) unless

California.

• Prizes and winnings received by

otherwise specified. For more information on

• Corporations not qualified through the

nonresidents for contests in California.

RDPs, get FTB Pub. 737, Tax Information for

California Secretary of State (CA SOS)

However, withholding is optional if the total

Registered Domestic Partners.

to do business in California or having no

payments of California source income are

permanent place of business in California.

$1,500 or less during the calendar year.

A

Purpose

• Partnerships or limited liability companies

For more information on withholding get

(LLCs) with no permanent place of

Use Form 590, Withholding Exemption

FTB Pub. 1017, Resident and Nonresident

business in California.

Certificate, to certify an exemption from

Withholding Guidelines. To get a withholding

• Any trust without a resident grantor,

nonresident withholding.

publication, see Additional Information.

beneficiary, or trustee, or estates where the

Form 590 does not apply to payments of

decedent was not a California resident.

C

Who Certifies this Form

backup withholding. For more information,

Foreign refers to non-U.S.

go to ftb.ca.gov and search for backup

Form 590 is certified by the payee. California

withholding.

For more information about determining

residents or entities exempt from the

resident status, get FTB Pub. 1031,

Form 590 does not apply to payments for

withholding requirement should complete

Guidelines for Determining Resident Status.

wages to employees. Wage withholding is

Form 590 and submit it to the withholding

Military servicemembers have special rules

administered by the California Employment

agent before payment is made. The withholding

for residency. For more information, get

Development Department (EDD). For more

agent is then relieved of the withholding

FTB Pub. 1032, Tax Information for Military

information, go to edd.ca.gov or call

requirements if the agent relies in good faith

Personnel.

888.745.3886.

on a completed and signed Form 590 unless

notified by the Franchise Tax Board (FTB) that

Permanent Place of Business:

Do not use Form 590 to certify an exemption

the form should not be relied upon.

A corporation has a permanent place of

from withholding if you are a Seller of

business in California if it is organized and

California real estate. Sellers of California

An incomplete certificate is invalid and the

existing under the laws of California or it has

real estate use Form 593-C, Real Estate

withholding agent should not accept it. If the

qualified through the CA SOS to transact

Withholding Certificate, to claim an exemption

withholding agent receives an incomplete

intrastate business. A corporation that has

from the real estate withholding requirement.

certificate, the withholding agent is required

not qualified to transact intrastate business

to withhold tax on payments made to the

The following are excluded from withholding

(e.g., a corporation engaged exclusively in

payee until a valid certificate is received. In

and completing this form:

interstate commerce) will be considered as

lieu of a completed exemption certificate, the

• The United States and any of its agencies or

having a permanent place of business in

withholding agent may accept a letter from

instrumentalities.

California only if it maintains a permanent

the payee as a substitute explaining why they

• A state, a possession of the United States,

office in California that is permanently staffed

are not subject to withholding. The letter must

the District of Columbia, or any of its

by its employees.

contain all the information required on the

political subdivisions or instrumentalities.

certificate in similar language, including the

E

Military Spouse Residency

• A foreign government or any of its political

under penalty of perjury statement and the

subdivisions, agencies, or instrumentalities.

Relief Act (MSRRA)

payee’s taxpayer identification number (TIN).

The withholding agent must retain a copy of

B

Income Subject to

Generally, for tax purposes you are considered

the certificate or substitute for at least five

to maintain your existing residence or domicile.

Withholding

years after the last payment to which the

If a military servicemember and nonmilitary

California Revenue and Taxation Code (R&TC)

certificate applies, and provide it upon request

spouse have the same state of domicile, the

to the FTB.

Section 18662 requires withholding of income

MSRRA provides:

or franchise tax on payments of California

If an entertainer (or the entertainer’s business

• A spouse shall not be deemed to have lost

source income made to nonresidents of

entity) is paid for a performance, the

a residence or domicile in any state solely

California.

entertainer’s information must be provided.

by reason of being absent to be with the

Do not submit the entertainer’s agent or

Withholding is required on the following, but is

servicemember serving in compliance with

not limited to:

promoter information.

military orders.

• A spouse shall not be deemed to have

• Payments to nonresidents for services

The grantor of a grantor trust shall be treated

acquired a residence or domicile in any

as the payee for withholding purposes.

rendered in California.

other state solely by reason of being there

• Distributions of California source income

Therefore, if the payee is a grantor trust and

to be with the servicemember serving in

made to domestic nonresident partners,

one or more of the grantors is a nonresident,

compliance with military orders.

members, and S corporation shareholders

withholding is required. If all of the grantors

on the trust are residents, no withholding is

and allocations of California source income

Domicile is defined as the one place:

made to foreign partners and members.

required. Resident grantors can check the

• Where you maintain a true, fixed, and

• Payments to nonresidents for rents if the

box on Form 590 labeled “Individuals —

permanent home.

payments are made in the course of the

Certification of Residency.”

• To which you intend to return whenever you

withholding agent’s business.

are absent.

• Payments to nonresidents for royalties

from activities sourced to California.

Form 590 Instructions 2016 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2