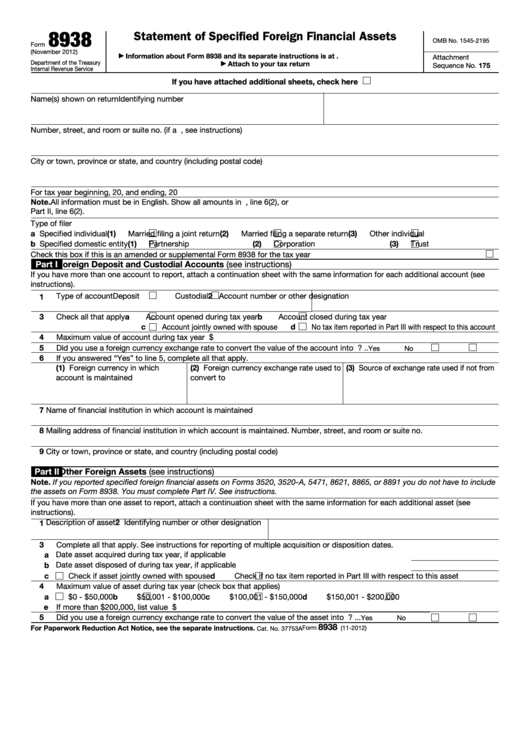

8938

Statement of Specified Foreign Financial Assets

OMB No. 1545-2195

Form

(November 2012)

Information about Form 8938 and its separate instructions is at

Attachment

▶

Department of the Treasury

Attach to your tax return

Sequence No. 175

▶

Internal Revenue Service

If you have attached additional sheets, check here

Name(s) shown on return

Identifying number

Number, street, and room or suite no. (if a P.O. box, see instructions)

City or town, province or state, and country (including postal code)

For tax year beginning

, 20

, and ending

, 20

Note. All information must be in English. Show all amounts in U.S. dollars. Show currency conversion rates in Part I, line 6(2), or

Part II, line 6(2).

Type of filer

a Specified individual

(1)

Married filing a joint return

(2)

Married filing a separate return

(3)

Other individual

b Specified domestic entity

(1)

Partnership

(2)

Corporation

(3)

Trust

Check this box if this is an amended or supplemental Form 8938 for the tax year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Part I

Foreign Deposit and Custodial Accounts (see instructions)

If you have more than one account to report, attach a continuation sheet with the same information for each additional account (see

instructions).

2 Account number or other designation

Type of account

Deposit

Custodial

1

3

Check all that apply

a

Account opened during tax year

b

Account closed during tax year

c

d

Account jointly owned with spouse

No tax item reported in Part III with respect to this account

4

Maximum value of account during tax year .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

$

5

Did you use a foreign currency exchange rate to convert the value of the account into U.S. dollars? .

.

Yes

No

6

If you answered “Yes” to line 5, complete all that apply.

(1) Foreign currency in which

(2) Foreign currency exchange rate used to

(3) Source of exchange rate used if not from

account is maintained

convert to U.S. dollars

U.S. Treasury Financial Management Service

7

Name of financial institution in which account is maintained

8

Mailing address of financial institution in which account is maintained. Number, street, and room or suite no.

9

City or town, province or state, and country (including postal code)

Part II

Other Foreign Assets (see instructions)

Note. If you reported specified foreign financial assets on Forms 3520, 3520-A, 5471, 8621, 8865, or 8891 you do not have to include

the assets on Form 8938. You must complete Part IV. See instructions.

If you have more than one asset to report, attach a continuation sheet with the same information for each additional asset (see

instructions).

2 Identifying number or other designation

Description of asset

1

3

Complete all that apply. See instructions for reporting of multiple acquisition or disposition dates.

a Date asset acquired during tax year, if applicable .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b Date asset disposed of during tax year, if applicable .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c

Check if asset jointly owned with spouse

d

Check if no tax item reported in Part III with respect to this asset

4

Maximum value of asset during tax year (check box that applies)

a

b

c

d

$0 - $50,000

$50,001 - $100,000

$100,001 - $150,000

$150,001 - $200,000

e If more than $200,000, list value

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

$

5

Did you use a foreign currency exchange rate to convert the value of the asset into U.S. dollars? .

.

.

Yes

No

8938

For Paperwork Reduction Act Notice, see the separate instructions.

Form

(11-2012)

Cat. No. 37753A

1

1 2

2