Form 211 - Commercial Tax

ADVERTISEMENT

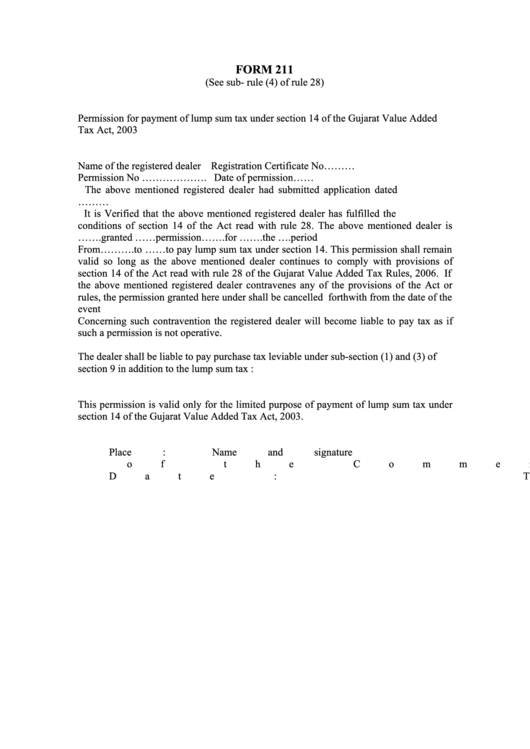

FORM 211

(See sub- rule (4) of rule 28)

Permission for payment of lump sum tax under section 14 of the Gujarat Value Added

Tax Act, 2003

Name of the registered dealer

Registration Certificate No………

Permission No ……………….

Date of permission……

The above mentioned registered dealer had submitted application dated

………..for permission to pay lump-sum tax under section 14 of the Act.

It is Verified that the above mentioned registered dealer has fulfilled the

conditions of section 14 of the Act read with rule 28. The above mentioned dealer is

…….granted ……permission…….for …….the ….period

From……….to ……to pay lump sum tax under section 14. This permission shall remain

valid so long as the above mentioned dealer continues to comply with provisions of

section 14 of the Act read with rule 28 of the Gujarat Value Added Tax Rules, 2006. If

the above mentioned registered dealer contravenes any of the provisions of the Act or

rules, the permission granted here under shall be cancelled forthwith from the date of the

event

Concerning such contravention the registered dealer will become liable to pay tax as if

such a permission is not operative.

The dealer shall be liable to pay purchase tax leviable under sub-section (1) and (3) of

section 9 in addition to the lump sum tax :

This permission is valid only for the limited purpose of payment of lump sum tax under

section 14 of the Gujarat Value Added Tax Act, 2003.

Place :

Name and signature

of the Commercial

Date :

Tax Officer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1