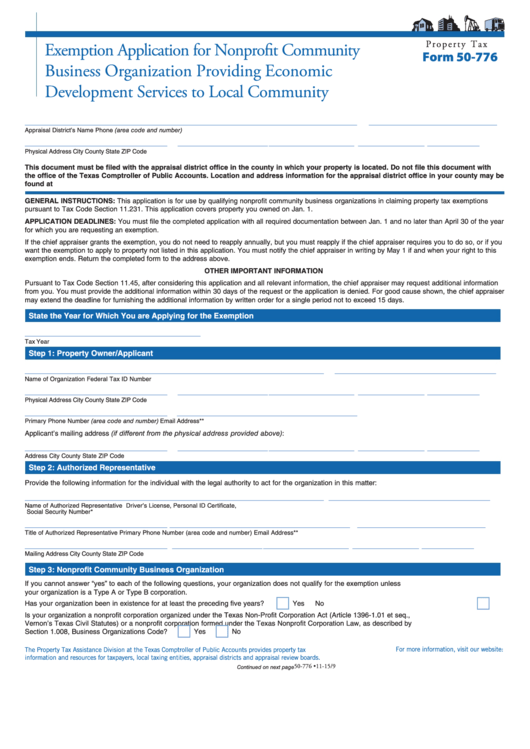

P r o p e r t y T a x

Exemption Application for Nonprofit Community

Form 50-776

Business Organization Providing Economic

Development Services to Local Community

______________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

______________________________

___________________ __________________

______________

___________

Physical Address

City

County

State

ZIP Code

This document must be filed with the appraisal district office in the county in which your property is located. Do not file this document with

the office of the Texas Comptroller of Public Accounts. Location and address information for the appraisal district office in your county may be

found at comptroller.texas.gov/propertytax/references/directory/cad.

GENERAL INSTRUCTIONS: This application is for use by qualifying nonprofit community business organizations in claiming property tax exemptions

pursuant to Tax Code Section 11.231. This application covers property you owned on Jan. 1.

APPLICATION DEADLINES: You must file the completed application with all required documentation between Jan. 1 and no later than April 30 of the year

for which you are requesting an exemption.

If the chief appraiser grants the exemption, you do not need to reapply annually, but you must reapply if the chief appraiser requires you to do so, or if you

want the exemption to apply to property not listed in this application. You must notify the chief appraiser in writing by May 1 if and when your right to this

exemption ends. Return the completed form to the address above.

OTHER IMPORTANT INFORMATION

Pursuant to Tax Code Section 11.45, after considering this application and all relevant information, the chief appraiser may request additional information

from you. You must provide the additional information within 30 days of the request or the application is denied. For good cause shown, the chief appraiser

may extend the deadline for furnishing the additional information by written order for a single period not to exceed 15 days.

State the Year for Which You are Applying for the Exemption

_____________________________________

Tax Year

Step 1: Property Owner/Applicant

_______________________________________________________________

__________________________________

Name of Organization

Federal Tax ID Number

______________________________

___________________ __________________

______________

___________

Physical Address

City

County

State

ZIP Code

______________________________

______________________________________

Primary Phone Number (area code and number)

Email Address**

Applicant’s mailing address (if different from the physical address provided above):

______________________________

___________________ __________________

______________

___________

Address

City

County

State

ZIP Code

Step 2: Authorized Representative

Provide the following information for the individual with the legal authority to act for the organization in this matter:

_______________________________________________________________

__________________________________

Name of Authorized Representative

Driver’s License, Personal ID Certificate,

Social Security Number*

______________________________

______________________________________

___________________________

Title of Authorized Representative

Primary Phone Number (area code and number)

Email Address**

______________________________

___________________ __________________

______________

___________

Mailing Address

City

County

State

ZIP Code

Step 3: Nonprofit Community Business Organization

If you cannot answer “yes” to each of the following questions, your organization does not qualify for the exemption unless

your organization is a Type A or Type B corporation.

Has your organization been in existence for at least the preceding five years? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Is your organization a nonprofit corporation organized under the Texas Non-Profit Corporation Act (Article 1396-1.01 et seq.,

Vernon’s Texas Civil Statutes) or a nonprofit corporation formed under the Texas Nonprofit Corporation Law, as described by

Section 1.008, Business Organizations Code? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

comptroller.texas.gov/taxinfo/proptax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-776 •11-15/9

Continued on next page

1

1 2

2 3

3 4

4