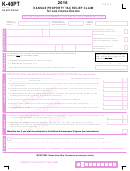

Form N-11 - State Tax Refund Worksheet - 2016

ADVERTISEMENT

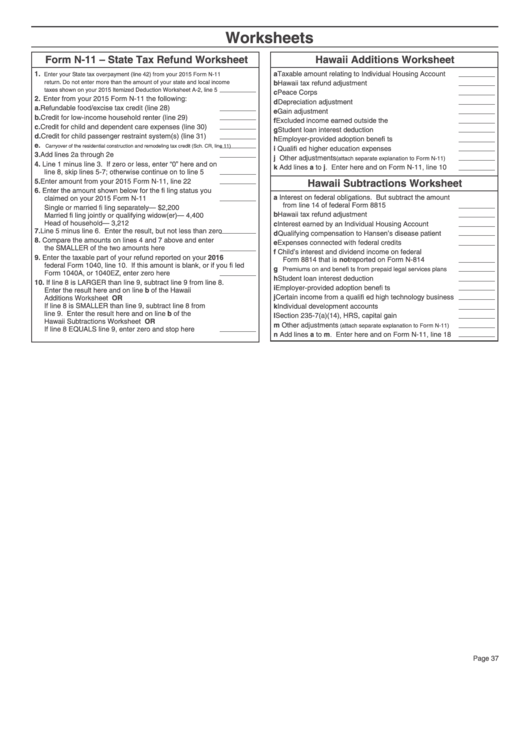

Worksheets

Form N-11 – State Tax Refund Worksheet

Hawaii Additions Worksheet

1. Enter your State tax overpayment (line 42) from your 2015 Form N-11

a Taxable amount relating to Individual Housing Account ............

return. Do not enter more than the amount of your state and local income

b Hawaii tax refund adjustment ........................................................

taxes shown on your 2015 Itemized Deduction Worksheet A-2, line 5 ...........

c Peace Corps compensation..........................................................

2. Enter from your 2015 Form N-11 the following:

d Depreciation adjustment ................................................................

a. Refundable food/excise tax credit (line 28) ..................................

e Gain adjustment .............................................................................

b. Credit for low-income household renter (line 29) ........................

f Excluded income earned outside the U.S. ..................................

c. Credit for child and dependent care expenses (line 30) .............

g Student loan interest deduction ....................................................

d. Credit for child passenger restraint system(s) (line 31) ..............

h Employer-provided adoption benefi ts ..........................................

e.

....

Carryover of the residential construction and remodeling tax credit (Sch. CR, line 11)

i Qualifi ed higher education expenses ...........................................

3. Add lines 2a through 2e .................................................................

j

Other adjustments (attach separate explanation to Form N-11) .................

4. Line 1 minus line 3. If zero or less, enter “0” here and on

k Add lines a to j. Enter here and on Form N-11, line 10 ............

line 8, skip lines 5-7; otherwise continue on to line 5 ..................

5. Enter amount from your 2015 Form N-11, line 22 ......................

Hawaii Subtractions Worksheet

6. Enter the amount shown below for the fi ling status you

a Interest on federal obligations. But subtract the amount

claimed on your 2015 Form N-11 ................................................

from line 14 of federal Form 8815 ................................................

Single or married fi ling separately—

$2,200

b Hawaii tax refund adjustment ........................................................

Married fi ling jointly or qualifying widow(er)—

4,400

Head of household—

3,212

c Interest earned by an Individual Housing Account .....................

7. Line 5 minus line 6. Enter the result, but not less than zero ......

d Qualifying compensation to Hansen’s disease patient ..............

8. Compare the amounts on lines 4 and 7 above and enter

e Expenses connected with federal credits ....................................

the SMALLER of the two amounts here .....................................

f Child’s interest and dividend income on federal

9. Enter the taxable part of your refund reported on your 2016

Form 8814 that is not reported on Form N-814 .........................

federal Form 1040, line 10. If this amount is blank, or if you fi led

g

...............

Premiums on and benefi ts from prepaid legal services plans

Form 1040A, or 1040EZ, enter zero here ...................................

h Student loan interest deduction ....................................................

10. If line 8 is LARGER than line 9, subtract line 9 from line 8.

i Employer-provided adoption benefi ts ..........................................

Enter the result here and on line b of the Hawaii

j Certain income from a qualifi ed high technology business .......

Additions Worksheet

OR

If line 8 is SMALLER than line 9, subtract line 8 from

k Individual development accounts .................................................

line 9. Enter the result here and on line b of the

l Section 235-7(a)(14), HRS, capital gain ......................................

Hawaii Subtractions Worksheet

OR

m Other adjustments (attach separate explanation to Form N-11) ..............

If line 8 EQUALS line 9, enter zero and stop here .....................

n Add lines a to m. Enter here and on Form N-11, line 18 ..........

Page 37

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1