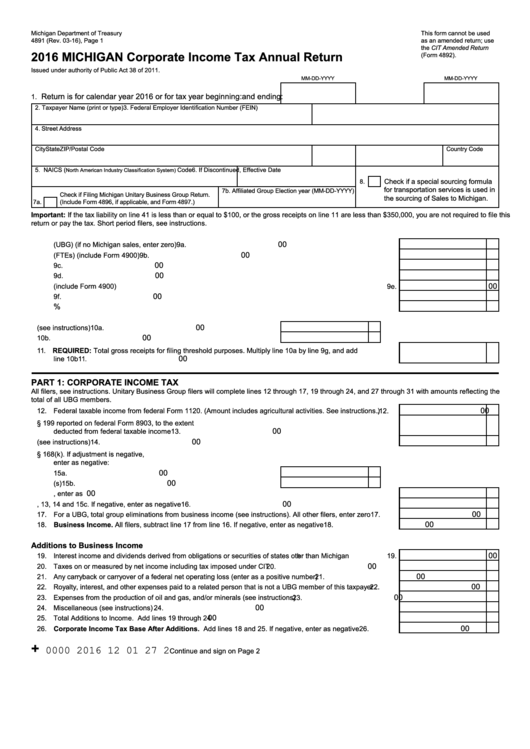

Form 4891 - Corporate Income Tax Annual Return - 2016

ADVERTISEMENT

Michigan Department of Treasury

This form cannot be used

4891 (Rev. 03-16), Page 1

as an amended return; use

the CIT Amended Return

2016 MICHIGAN Corporate Income Tax Annual Return

(Form 4892).

Issued under authority of Public Act 38 of 2011.

MM-DD-YYYY

MM-DD-YYYY

Return is for calendar year 2016 or for tax year beginning:

and ending:

1.

2. Taxpayer Name (print or type)

3. Federal Employer Identification Number (FEIN)

4. Street Address

City

State

ZIP/Postal Code

Country Code

5. NAICS (

Code

6. If Discontinued, Effective Date

North American Industry Classification System)

Check if a special sourcing formula

8.

for transportation services is used in

7b. Affiliated Group Election year (MM-DD-YYYY)

Check if Filing Michigan Unitary Business Group Return.

the sourcing of Sales to Michigan.

7a.

(Include Form 4896, if applicable, and Form 4897.)

Important: If the tax liability on line 41 is less than or equal to $100, or the gross receipts on line 11 are less than $350,000, you are not required to file this

return or pay the tax. Short period filers, see instructions.

9. Apportionment Calculation

00

a. Michigan sales of the corporation/Unitary Business Group (UBG) (if no Michigan sales, enter zero) ...... 9a.

00

b. Proportionate Michigan sales from unitary Flow-Through Entities (FTEs) (include Form 4900) ............... 9b.

00

c. Michigan sales. Add lines 9a and 9b .........................................................................................................

9c.

00

d. Total sales of the corporation/UBG ............................................................................................................ 9d.

00

e. Proportionate total sales from unitary FTEs (include Form 4900) ............................................................... 9e.

00

f.

Total sales. Add lines 9d and 9e ................................................................................................................

9f.

%

g. Apportionment percentage. Divide 9c by 9f............................................................................................... 9g.

00

10. a. Gross receipts from corporate activities (see instructions) .......... 10a.

00

10. b. Apportioned gross receipts from FTEs ........................................ 10b.

11. REQUIRED: Total gross receipts for filing threshold purposes. Multiply line 10a by line 9g, and add

00

line 10b ............................................................................................................................................................

11.

PART 1: CORPORATE INCOME TAX

All filers, see instructions. Unitary Business Group filers will complete lines 12 through 17, 19 through 24, and 27 through 31 with amounts reflecting the

total of all UBG members.

00

12. Federal taxable income from federal Form 1120. (Amount includes agricultural activities. See instructions.) .

12.

13. Domestic production activities deduction based on IRC § 199 reported on federal Form 8903, to the extent

00

deducted from federal taxable income ............................................................................................................

13.

00

14. Miscellaneous (see instructions) .....................................................................................................................

14.

15. Adjustments due to decoupling of Michigan depreciation from IRC § 168(k). If adjustment is negative,

enter as negative:

00

a. Net bonus depreciation adjustment ............................................. 15a.

00

b. Gain/loss adjustment on sale of eligible depreciable asset(s) ..... 15b.

00

c. Add lines 15a and 15b. If negative, enter as negative.............................................................................. 15c.

00

16. Add lines 12, 13, 14 and 15c. If negative, enter as negative ...........................................................................

16.

00

17. For a UBG, total group eliminations from business income (see instructions). All other filers, enter zero ......

17.

00

18. Business Income. All filers, subtract line 17 from line 16. If negative, enter as negative ..............................

18.

Additions to Business Income

00

19. Interest income and dividends derived from obligations or securities of states other than Michigan ................

19.

00

20. Taxes on or measured by net income including tax imposed under CIT ..........................................................

20.

00

21. Any carryback or carryover of a federal net operating loss (enter as a positive number) .................................

21.

00

22. Royalty, interest, and other expenses paid to a related person that is not a UBG member of this taxpayer ....

22.

00

23. Expenses from the production of oil and gas, and/or minerals (see instructions) ............................................

23.

00

24. Miscellaneous (see instructions) .....................................................................................................................

24.

00

25. Total Additions to Income. Add lines 19 through 24.........................................................................................

25.

00

26. Corporate Income Tax Base After Additions. Add lines 18 and 25. If negative, enter as negative ............

26.

+

0000 2016 12 01 27 2

Continue and sign on Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2