Case Name:

Case Number:

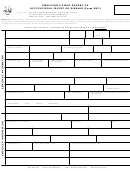

FINANCIAL AFFIDAVIT

7/8.

Asset Information - You must list all of your assets in these sections. In section 7, the first column is for your good-faith estimate

of the total fair market value of assets in each category. Fair Market Value is what you could sell an asset for, not the purchase

price or replacement cost. It is not necessary to have every asset appraised. However, you must consider all factors known to

you when stating values. The second column is to list any debts that are owed against the asset, such as a mortgage or a

vehicle loan. You may put any additional information in the third column.

Motor Vehicles means cars, trucks, motorcycles, airplanes, boats, snowmobiles and the like.

Investments means savings accounts, certificates of deposit, stocks, savings bonds, other bonds, money market accounts,

and the like.

Life insurance means the cash value of any life insurance policy that you own or have an interest in.

Pension means a defined benefit retirement plan. What you receive is based on years of service and pay.

Retirement Account means a defined contribution plan or other retirement account in your name.

Examples are: 401(k) plans, thrift/savings plans, Keoghs, IRAs.

The extra lines are for other categories of assets that are not listed on the form, or for providing more details on listed assets. You

must list all assets. Assets include, but are not limited to, the following:

Any asset in which you have an interest, but that is being held in the name of someone else. For example, if a relative

is holding money or an asset that you own, or can get back under any circumstances, you must include it.

Any assets that are owned partly by you and partly by someone else, such as a jointly owned bank account, motorcycle,

or piece of real estate.

Any asset of substantial value that you either gave away or sold for less than fair market value, within 6 months of the

date of the Financial Affidavit.

Any debt that anyone owes you, whether or not repayment is expected or likely.

9.

Tax Return Information - Total W-2s and 1099s refer to those tax forms from work done by you and from assets in your

name. Do not include those that result from your spouse's income.

10.

Insurance - List all insurance coverage you have. Description means any deductibles and co-pays.

11.

Debts - List all debts in your name or joint names. Debt means loans, credit cards, past due bills, and the like. For each

debt, list the name of the person or business you owe the debt to, whether the debt is in your name or in joint names,

and the amount currently owed.

12.

Pension and Retirement Accounts - Name your retirement plans or accounts. On the second line, note if your retirement

account is a 401(k) plan, profit-sharing plan, defined benefit plan, or other specific type of plan. A defined benefit plan is one

where what you receive is based upon years of service and pay. Value at filing refers to the value of your retirement plan at the

time the divorce was filed, and needs to be filled in only in divorce cases.

13.

List of Attachments - Check off which forms and documents you are attaching to your Financial Affidavit. If the attachment is not

listed, check off other and write in what it is.

14.

Additional Information - Use this space to provide information that will not fit in prior sections and to provide additional

information that you wish the Court to consider.

Certification of Copies - You must give a copy of your Financial Affidavit with all attachments to the other side. The other side means

the lawyer representing your spouse, ex-spouse, or the other parent. If he or she does not have a lawyer, give it to your spouse, ex-

spouse, or the other parent. If the State is a party, also give a copy to Office of Child Support Enforcement (OCSE). Write in the

names of each person you have given a copy to.

Monthly Expenses - Section D above explains who must complete the Monthly Expenses form.

Top of 1st Page

NHJB-2065-FS (03/25/2013)

Page 5 of 5

1

1 2

2 3

3 4

4 5

5