Family Law Financial Affidavit - Florida Judicial Circuit

ADVERTISEMENT

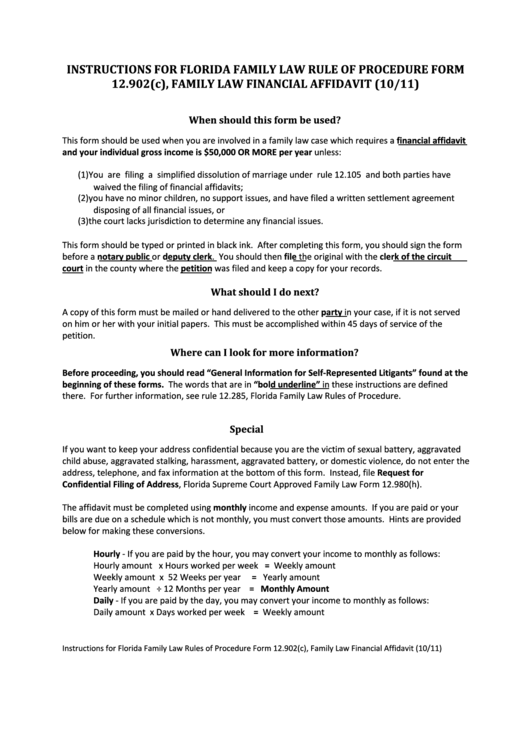

INSTRUCTIONS FOR FLORIDA FAMILY LAW RULE OF PROCEDURE FORM

12.902(c), FAMILY LAW FINANCIAL AFFIDAVIT (10/11)

When should this form be used?

This form should be used when you are involved in a family law case which requires a financial affidavit

and your individual gross income is $50,000 OR MORE per year unless:

(1) You are filing a simplified dissolution of marriage under rule 12.105 and both parties have

waived the filing of financial affidavits;

(2) you have no minor children, no support issues, and have filed a written settlement agreement

disposing of all financial issues, or

(3) the court lacks jurisdiction to determine any financial issues.

This form should be typed or printed in black ink. After completing this form, you should sign the form

before a notary public or deputy clerk. You should then file the original with the clerk of the circuit

court in the county where the petition was filed and keep a copy for your records.

What should I do next?

A copy of this form must be mailed or hand delivered to the other party in your case, if it is not served

on him or her with your initial papers. This must be accomplished within 45 days of service of the

petition.

Where can I look for more information?

Before proceeding, you should read “General Information for Self-Represented Litigants” found at the

beginning of these forms. The words that are in “bold underline” in these instructions are defined

there. For further information, see rule 12.285, Florida Family Law Rules of Procedure.

Special notes...

If you want to keep your address confidential because you are the victim of sexual battery, aggravated

child abuse, aggravated stalking, harassment, aggravated battery, or domestic violence, do not enter the

address, telephone, and fax information at the bottom of this form.

Instead, file Request for

Confidential Filing of Address, Florida Supreme Court Approved Family Law Form 12.980(h).

The affidavit must be completed using monthly income and expense amounts. If you are paid or your

bills are due on a schedule which is not monthly, you must convert those amounts. Hints are provided

below for making these conversions.

Hourly - If you are paid by the hour, you may convert your income to monthly as follows:

Hourly amount

x

Hours worked per week

=

Weekly amount

Weekly amount

x

52 Weeks per year

=

Yearly amount

Yearly amount

÷

12 Months per year

=

Monthly Amount

Daily - If you are paid by the day, you may convert your income to monthly as follows:

Daily amount

x

Days worked per week

=

Weekly amount

Instructions for Florida Family Law Rules of Procedure Form 12.902(c), Family Law Financial Affidavit (10/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14