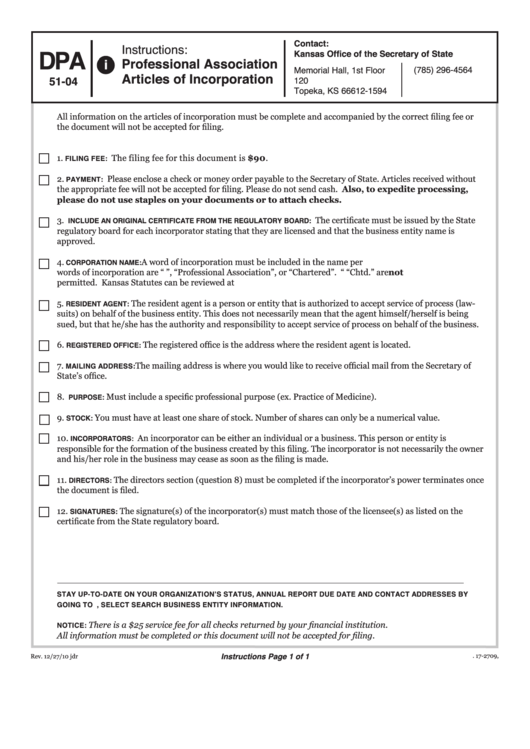

Form Dpa 51-04 - Professional Association Articles Of Incorporation

ADVERTISEMENT

Contact:

Instructions:

DPA

Kansas Office of the Secretary of State

Professional Association

i

Memorial Hall, 1st Floor

(785) 296-4564

Articles of Incorporation

51-04

120 S.W. 10th Avenue

kssos@sos.ks.gov

Topeka, KS 66612-1594

All information on the articles of incorporation must be complete and accompanied by the correct filing fee or

the document will not be accepted for filing.

1.

The filing fee for this document is $90.

FILING FEE:

2.

Please enclose a check or money order payable to the Secretary of State. Articles received without

PAYMENT:

the appropriate fee will not be accepted for filing. Please do not send cash. Also, to expedite processing,

please do not use staples on your documents or to attach checks.

3.

INCLUDE AN ORIGINAL CERTIFICATE FROM THE REGULATORY BOARD:

The certificate must be issued by the State

regulatory board for each incorporator stating that they are licensed and that the business entity name is

approved.

4.

A word of incorporation must be included in the name per K.S.A. 17-2711. Permitted

CORPORATION NAME:

words of incorporation are “P.A.”, “Professional Association”, or “Chartered”. “P.C. and “Chtd.” are not

permitted. Kansas Statutes can be reviewed at

5.

RESIDENT AGENT:

The resident agent is a person or entity that is authorized to accept service of process (law-

suits) on behalf of the business entity. This does not necessarily mean that the agent himself/herself is being

sued, but that he/she has the authority and responsibility to accept service of process on behalf of the business.

6.

REGISTERED OFFICE:

The registered office is the address where the resident agent is located.

7.

The mailing address is where you would like to receive official mail from the Secretary of

MAILING ADDRESS:

State’s office.

8.

PURPOSE:

Must include a specific professional purpose (ex. Practice of Medicine).

9.

You must have at least one share of stock. Number of shares can only be a numerical value.

STOCK:

10.

An incorporator can be either an individual or a business. This person or entity is

INCORPORATORS:

responsible for the formation of the business created by this filing. The incorporator is not necessarily the owner

and his/her role in the business may cease as soon as the filing is made.

11.

DIRECTORS:

The directors section (question 8) must be completed if the incorporator’s power terminates once

the document is filed.

12.

SIGNATURES:

The signature(s) of the incorporator(s) must match those of the licensee(s) as listed on the

certificate from the State regulatory board.

STAY UP-TO-DATE ON YOUR ORGANIZATION’S STATUS, ANNUAL REPORT DUE DATE AND CONTACT ADDRESSES BY

GOING TO UNDER QUICK LINKS, SELECT SEARCH BUSINESS ENTITY INFORMATION.

There is a $25 service fee for all checks returned by your financial institution.

NOTICE:

All information must be completed or this document will not be accepted for filing.

Instructions Page 1 of 1

K.S.A . 17-2709,

Rev. 12/27/10 jdr

K.S.A. 17-6002

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3