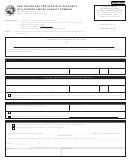

APPLICATION FOR A CERTIFICATE OF AUTHORITY FOREIGN CORPORATION

Filing Fee: $385.00 STOCK

$40.00 NON-STOCK

A foreign corporation desiring to transact business in Connecticut may obtain a certificate of authority by filing

the Application for Certificate of Authority. The Application includes an appointment of the registered agent.

A certificate of the corporation's legal existence (some states refer to this as a certificate of good standing)

from the state of incorporation, authenticated by a proper officer of that state, must accompany the Application

for Certificate of Authority. Such certificate must be received within 90 days from the date of issuance.

Please note that the name of the foreign corporation filing an application for a certificate of authority must contain a word

or words of corporate designation, even if the laws of its state of incorporation do not so require. If specific words or

abbreviations are regarded as corporate designations in a foreign language, the filing must be accompanied by a legal

opinion stating that fact. Documents submitted in any language other than English require an English translation.

FAILURE TO PROVIDE ANY OF THE ABOVE INFORMATION WILL RESULT IN THE REJECTION OF THE

DOCUMENT.

Also, the foreign corporation’s name must be distinguishable from the name of another active business on our records;

when it is not, the corporation may adopt for use in this state a fictitious name. The fictitious name must be

distinguishable from other business names on record and must contain a word or words of corporate designation, such

as “incorporated” or an abbreviation such as “corp”.

If the corporation wishes to adopt a fictitious name for use in Connecticut, it must present for filing a resolution by its

board of directors, certified by its secretary, adopting the fictitious name along with its Application for Certificate of

Authority. Please also note the following information relating to the use of a fictitious name: a fictitious name may only

be used by a foreign corporation when its real name is unavailable for use in Connecticut; once the real name of the

corporation becomes available, the fictitious name may no longer be used; the corporation may not amend its

certificate of authority to change a fictitious name; if a fictitious name is used, the corporation will be indexed on our

records under that name and no other.

In the event a foreign corporation holding a certificate of authority changes its corporate name, place of incorporation,

or the period of its duration, it must apply for an amended certificate of authority.

Please contact the Department of Revenue Services or your tax advisor as to any potential tax

liability relating to your business.

MAKE CHECKS PAYABLE TO THE SECRETARY OF THE STATE

FORM CFAS-1-1.0

DO NOT SCAN THIS PAGE

INSTRUCTIONS

Rev. 8/2012

1

1 2

2 3

3 4

4 5

5 6

6