Prevailing Wage Job Acknowledgment Form Page 4

ADVERTISEMENT

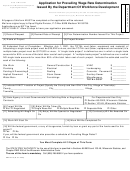

City of Santa Monica

Prevailing Wage Job Acknowledgment Form

Page 4 of 5

California Prevailing Wage Laws:

§ 1727 (a) Before making payments to the contractor of money due under a contract for public work, the awarding body shall

withhold and retain therefrom all amounts required to satisfy any civil wage and penalty assessment issued by the Labor

Commissioner under this chapter. The amounts required to satisfy a civil wage and penalty assessment shall not be disbursed by the

awarding body until receipt of a final order that is no longer subject to judicial review.

§ 1773.2. Specification of general wage rate in call for bids, in bid specifications and in contract; posting at job site

The body awarding any contract for public work, or otherwise undertaking any public work, shall specify in the call for bids for the

contract, and in the bid specifications and in the contract itself, what the general rate of per diem wages is for each craft,

classification, or type of worker needed to execute the contract. In lieu of specifying the rate of wages in the call for bids, and in the

bid specifications and in the contract itself, the awarding body may, in the call for bids, bid specifications, and contract, include a

statement that copies of the prevailing rate of per diem wages are on file at its principal office, which shall be made available to any

interested party on request. The awarding body shall also cause a copy of the determination of the director of the prevailing rate of

per diem wages to be posted at each job site.

§ 1775. Penalties for violations

(a) (1) The contractor and any subcontractor under the contractor shall, as a penalty to the state or political subdivision on whose

behalf the contract is made or awarded, forfeit not more than two hundred dollars ($200) for each calendar day, or portion thereof,

for each worker paid less than the prevailing wage rates as determined by the director for the work or craft in which the worker is

employed for any public work done under the contract by the contractor or, except as provided in subdivision (b), by any

subcontractor under the contractor.

(B) (i) The penalty may not be less than forty dollars ($40) for each calendar day, or portion thereof, for each worker paid less than the

prevailing wage rate, unless the failure of the contractor or subcontractor to pay the correct rate of per diem wages was a good faith

mistake and, if so, the error was promptly and voluntarily corrected when brought to the attention of the contractor or subcontractor.

§ 1777.7. Violations of § 1777.5; civil penalty; procedures

(a) (1) If the Labor Commissioner or his or her designee determines after an investigation that a contractor or subcontractor knowingly

violated Section 1777.5, the contractor and any subcontractor responsible for the violation shall forfeit, as a civil penalty to the state

or political subdivision on whose behalf the contract is made or awarded, not more than one hundred dollars ($100) for each full

calendar day of noncompliance. The amount of this penalty may be reduced by the Labor Commissioner if the amount of the penalty

would be disproportionate to the severity of the violation. A contractor or subcontractor that knowingly commits a second or

subsequent violation within a three-year period, if the noncompliance results in apprenticeship training not being provided as

required by this chapter, shall forfeit as a civil penalty the sum of not more than three hundred dollars ($300) for each full calendar

day of noncompliance.

(4) Prior to making final payment to the subcontractor for work performed on the public works project, the contractor shall obtain an

affidavit signed under penalty of perjury from the subcontractor that the subcontractor has paid the specified general prevailing rate

of per diem wages to his or her employees on the public works project and any amounts due pursuant to Section 1813.

§ 1776 (h) The contractor or subcontractor has 10 days in which to comply subsequent to receipt of a written notice requesting the

records enumerated in subdivision (a) (Certified Payrolls). In the event that the contractor or subcontractor fails to comply within the

10-day period, he or she shall, as a penalty to the state or political subdivision on whose behalf the contract is made or awarded,

forfeit one hundred dollars ($100) for each calendar day, or portion thereof, for each worker, until strict compliance is effectuated.

Upon the request of the Division of Labor Standards Enforcement, these penalties shall be withheld from progress payments then

due. A contractor is not subject to a penalty assessment pursuant to this section due to the failure of a subcontractor to comply with

this section.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5