Income Tax Unusual Circumstances

ADVERTISEMENT

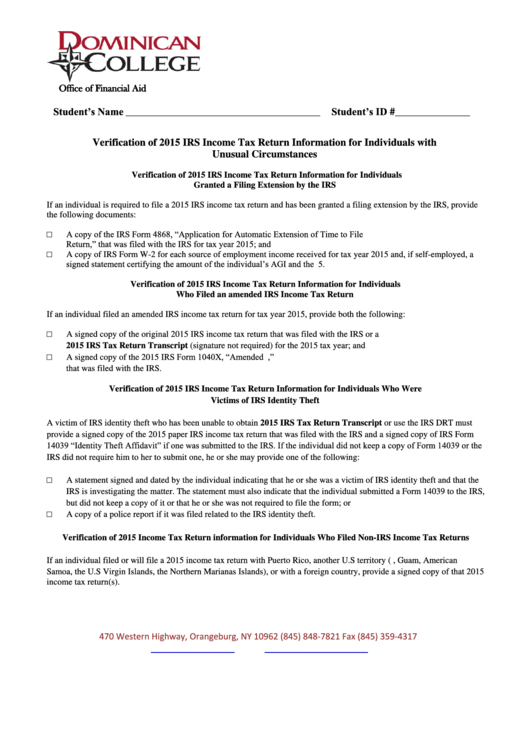

Office of Financial Aid

Student’s Name

Student’s ID #

____________________________________________

_________________

Verification of 2015 IRS Income Tax Return Information for Individuals with

Unusual Circumstances

Verification of 2015 IRS Income Tax Return Information for Individuals

Granted a Filing Extension by the IRS

If an individual is required to file a 2015 IRS income tax return and has been granted a filing extension by the IRS, provide

the following documents:

A copy of the IRS Form 4868, “Application for Automatic Extension of Time to File U.S. Individual Income Tax

□

Return,” that was filed with the IRS for tax year 2015; and

□

A copy of IRS Form W-2 for each source of employment income received for tax year 2015 and, if self-employed, a

signed statement certifying the amount of the individual’s AGI and the U.S. Income tax paid for tax year 2015.

Verification of 2015 IRS Income Tax Return Information for Individuals

Who Filed an amended IRS Income Tax Return

If an individual filed an amended IRS income tax return for tax year 2015, provide both the following:

□

A signed copy of the original 2015 IRS income tax return that was filed with the IRS or a

2015 IRS Tax Return Transcript (signature not required) for the 2015 tax year; and

A signed copy of the 2015 IRS Form 1040X, “Amended U.S. Individual Income Tax Return,”

□

that was filed with the IRS.

Verification of 2015 IRS Income Tax Return Information for Individuals Who Were

Victims of IRS Identity Theft

A victim of IRS identity theft who has been unable to obtain 2015 IRS Tax Return Transcript or use the IRS DRT must

provide a signed copy of the 2015 paper IRS income tax return that was filed with the IRS and a signed copy of IRS Form

14039 “Identity Theft Affidavit” if one was submitted to the IRS. If the individual did not keep a copy of Form 14039 or the

IRS did not require him to her to submit one, he or she may provide one of the following:

□

A statement signed and dated by the individual indicating that he or she was a victim of IRS identity theft and that the

IRS is investigating the matter. The statement must also indicate that the individual submitted a Form 14039 to the IRS,

but did not keep a copy of it or that he or she was not required to file the form; or

□

A copy of a police report if it was filed related to the IRS identity theft.

Verification of 2015 Income Tax Return information for Individuals Who Filed Non-IRS Income Tax Returns

If an individual filed or will file a 2015 income tax return with Puerto Rico, another U.S territory (e.g., Guam, American

Samoa, the U.S Virgin Islands, the Northern Marianas Islands), or with a foreign country, provide a signed copy of that 2015

income tax return(s).

470 Western Highway, Orangeburg, NY 10962 (845) 848-7821 Fax (845) 359-4317

financial.aid@dc.edu

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1