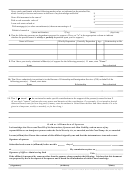

I-134, Affidavit Of Support - Nice Page 3

ADVERTISEMENT

OMB No. 1615-0014; Exp. 04-30-07

U.S. Department of Homeland Security

I-134, Affidavit of Support

Bureau of Citizenship and Immigration Services

Instructions

III. Sponsor and Alien Liability.

I. Execution of Affidavit.

Effective October 1, 1980, amendments to section 1614(f) of

A separate affidavit must be submitted for each person. As

the Social Security Act and Part A of Title XVI of the Social

the sponsor, you must sign the affidavit in your full, true

Security Act establish certain requirements for determining

and correct name and affirm or make it under oath.

the eligibility of aliens who apply for the first time for

Supplemental Security Income (SSI) benefits.

If you are in the United States, the affidavit may be

sworn to or affirmed before an officer of the

Effective October 1, 1981, amendments to section 415 of the

Bureau of Citizenship and Immigration Services

Social Security Act establish similar requirements for

(CIS) without the payment of fee, or before a

determining the eligibility of aliens who apply for the first

notary public or other officers authorized to

time for Aid to Families with Dependent Children (AFDC),

administer oaths for general purposes, in which

currently administered under Temporary Assistance for

case the official seal or certificate of authority to

Needy Families (TANF). Effective December 22, 1981,

administer oaths must be affixed.

amendments to the Food Stamp Act of 1977 affect the

eligibility of alien participation in the Food Stamp Program.

If you are outside the United States, the affidavit

These amendments require that the income and resources of

must be sworn to or affirmed before a U.S.

any person, who as the sponsor of an alien's entry into the

consular or immigration officer.

United States, executes an affidavit of support or similar

agreement on behalf of the alien, and the income and

resources of the sponsor's spouse (if living with the

II. Supporting Evidence.

sponsor) shall be deemed to be the income and resources of

the alien under formulas for determining eligibility for SSI,

As the sponsor, you must show you have sufficient income

TANF and Food Stamp benefits during the three years

and/or financial resources to assure that the alien you are

following the alien's entry into the United States.

sponsoring will not become a public charge while in the

United States.

Documentation on Income and Resources.

Evidence should consist of copies of any or all of the

An alien applying for SSI must make available to the Social

following documentation listed below that are applicable to

Security Administration documentation concerning his or

your situation.

her income and resources and those of the sponsor,

including information that was provided in support of the

Failure to provide evidence of sufficient income and/or

application for an immigrant visa or adjustment of status.

financial resources may result in the denial of the alien's

application for a visa or his or her removal from the United

An alien applying for TANF or Food Stamps must make

States.

similar information available to the State public assistance

agency.

The sponsor must submit in duplicate evidence of income

and resources, as appropriate:

The Secretary of Health and Human Services and the

Secretary of Agriculture are authorized to obtain copies of

any such documentation submitted to the CIS or the U.S.

A. Statement from an officer of the bank or other financial

Department of State and to release such documentation to a

institution where you have deposits, giving the

State public assistance agency.

following details regarding your account:

1. Date account opened;

Joint and Several Liability Issues.

2. Total amount deposited for the past year;

3. Present balance.

Sections 1621(e) and 415(d) of the Social Security Act and

subsection 5(i) of the Food Stamp Act also provide that an

B. Statement of your employer on business stationery,

alien and his or her sponsor shall be jointly and severally

showing:

liable to repay any SSI, TANF or Food Stamp benefits that

1. Date and nature of employment;

are incorrectly paid because of misinformation provided by

2. Salary paid;

a sponsor or because of a sponsor's failure to provide

3. Whether the position is temporary or permanent.

information.

C. If self-employed:

1. Copy of last income tax return filed; or

Incorrect payments that are not repaid will be withheld from

2. Report of commercial rating concern.

any subsequent payments for which the alien or sponsor

are otherwise eligible under the Social Security Act or Food

D. List containing serial numbers and denominations of

Stamp Act, except that the sponsor was without fault or

bonds and name of record owner(s).

where good cause existed.

Form I-134 (Rev. 06/17/04)N (Prior versions may be used until 09/30/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4