Clear Form

Print Form

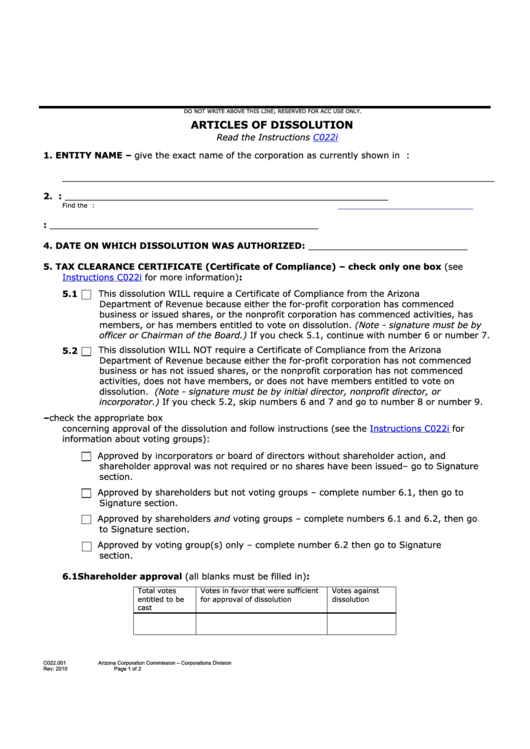

DO NOT WRITE ABOVE THIS LINE; RESERVED FOR ACC USE ONLY.

ARTICLES OF DISSOLUTION

Read the Instructions

C022i

1.

ENTITY NAME – give the exact name of the corporation as currently shown in A.C.C. records:

_______________________________________________________________________

2.

A.C.C. FILE NUMBER: ___________________________________________________________

Find the A.C.C. file number on the upper corner of filed documents OR on our website at:

DATE OF INCORPORATION: _________________________________________________

3.

4.

DATE ON WHICH DISSOLUTION WAS AUTHORIZED: _____________________________

5.

TAX CLEARANCE CERTIFICATE (Certificate of Compliance) – check only one box (see

Instructions C022i

for more information):

5.1

This dissolution WILL require a Certificate of Compliance from the Arizona

Department of Revenue because either the for-profit corporation has commenced

business or issued shares, or the nonprofit corporation has commenced activities, has

members, or has members entitled to vote on dissolution. (Note - signature must be by

officer or Chairman of the Board.) If you check 5.1, continue with number 6 or number 7.

This dissolution WILL NOT require a Certificate of Compliance from the Arizona

5.2

Department of Revenue because either the for-profit corporation has not commenced

business or has not issued shares, or the nonprofit corporation has not commenced

activities, does not have members, or does not have members entitled to vote on

dissolution. (Note - signature must be by initial director, nonprofit director, or

incorporator.) If you check 5.2, skip numbers 6 and 7 and go to number 8 or number 9.

6.

FOR-PROFIT CORPORATIONS THAT CHECKED NUMBER 5.1 – check the appropriate box

concerning approval of the dissolution and follow instructions (see the

Instructions C022i

for

information about voting groups):

Approved by incorporators or board of directors without shareholder action, and

shareholder approval was not required or no shares have been issued– go to Signature

section.

Approved by shareholders but not voting groups – complete number 6.1, then go to

Signature section.

Approved by shareholders and voting groups – complete numbers 6.1 and 6.2, then go

to Signature section.

Approved by voting group(s) only – complete number 6.2 then go to Signature

section.

6.1

Shareholder approval (all blanks must be filled in):

Total votes

Votes in favor that were sufficient

Votes against

entitled to be

for approval of dissolution

dissolution

cast

C022.001

Arizona Corporation Commission – Corporations Division

Rev: 2010

Page 1 of 2

1

1 2

2