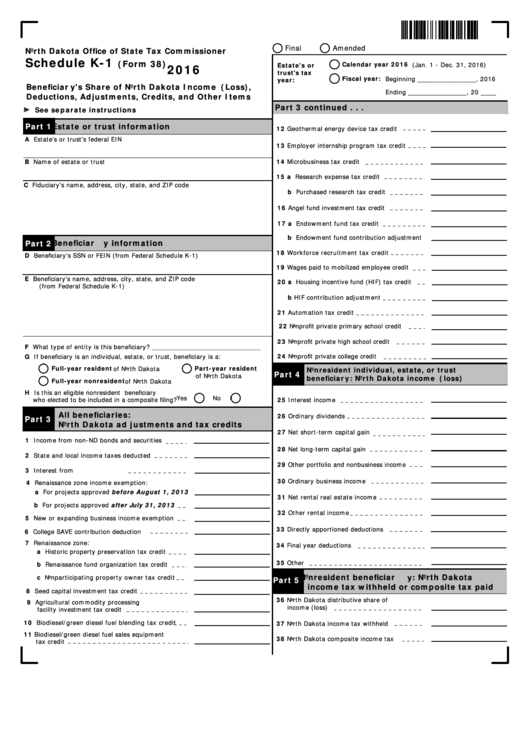

Schedule K-1 (Form 38) - Beneficiary'S Share Of North Dakota Income (Loss),deductions, Adjustments, Credits, And Other Items - 2016

ADVERTISEMENT

Final

Amended

North Dakota Office of State Tax Commissioner

Schedule K-1

(Form 38)

Calendar year 2016

(Jan. 1 - Dec. 31, 2016)

Estate's or

2016

trust's tax

Fiscal year:

Beginning _______________, 2016

year:

Beneficiary's Share of North Dakota Income (Loss),

Ending _______________, 20 ____

Deductions, Adjustments, Credits, and Other Items

Part 3 continued . . .

See separate instructions

Part 1

Estate or trust information

12 Geothermal energy device tax credit

A Estate's or trust's federal EIN

13 Employer internship program tax credit

B Name of estate or trust

14 Microbusiness tax credit

15 a Research expense tax credit

C Fiduciary's name, address, city, state, and ZIP code

b Purchased research tax credit

16 Angel fund investment tax credit

17 a Endowment fund tax credit

b Endowment fund contribution adjustment

Beneficiary information

Part 2

18 Workforce recruitment tax credit

D Beneficiary's SSN or FEIN (from Federal Schedule K-1)

19 Wages paid to mobilized employee credit

E Beneficiary's name, address, city, state, and ZIP code

20 a Housing incentive fund (HIF) tax credit

(from Federal Schedule K-1)

b HIF contribution adjustment

21 Automation tax credit

22 Nonprofit private primary school credit

23 Nonprofit private high school credit

F What type of entity is this beneficiary? ____________________________

G If beneficiary is an individual, estate, or trust, beneficiary is a:

24 Nonprofit private college credit

Full-year resident

Part-year resident

of North Dakota

Nonresident individual, estate, or trust

Part 4

of North Dakota

beneficiary: North Dakota income (loss)

Full-year nonresident of North Dakota

H Is this an eligible nonresident beneficiary

Yes

No

who elected to be included in a composite filing?

25 Interest income

All beneficiaries:

26 Ordinary dividends

Part 3

North Dakota adjustments and tax credits

27 Net short-term capital gain

1 Income from non-ND bonds and securities

28 Net long-term capital gain

2 State and local income taxes deducted

29 Other portfolio and nonbusiness income

3 Interest from U.S. obligations

30 Ordinary business income

4 Renaissance zone income exemption:

a For projects approved before August 1, 2013

31 Net rental real estate income

i

b For projects approved after July 31, 2013

32 Other rental income

5 New or expanding business income exemption

33 Directly apportioned deductions

6 College SAVE contribution deduction

7 Renaissance zone:

34 Final year deductions

a Historic property preservation tax credit

35 Other

b Renaissance fund organization tax credit

Nonresident beneficiary: North Dakota

c Nonparticipating property owner tax credit

Part 5

income tax withheld or composite tax paid

8 Seed capital investment tax credit

36 North Dakota distributive share of

9 Agricultural commodity processing

income (loss)

facility investment tax credit

10 Biodiesel/green diesel fuel blending tax credit

37 North Dakota income tax withheld

11 Biodiesel/green diesel fuel sales equipment

38 North Dakota composite income tax

tax credit

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3