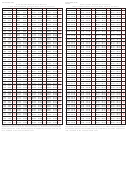

8% Sales And Use Tax Chart Page 2

ADVERTISEMENT

8

%

Sales and Use Tax Chart

(continued)

Through

Tax

Through

Tax

Through

Tax

Through

Tax

Through

Tax

30.06

2.40

34.81

2.78

39.56

3.16

44.31

3.54

49.06

3.92

30.18

2.41

34.93

2.79

39.68

3.17

44.43

3.55

49.18

3.93

30.31

2.42

35.06

2.80

39.81

3.18

44.56

3.56

49.31

3.94

30.43

2.43

35.18

2.81

39.93

3.19

44.68

3.57

49.43

3.95

30.56

2.44

35.31

2.82

40.06

3.20

44.81

3.58

49.56

3.96

30.68

2.45

35.43

2.83

40.18

3.21

44.93

3.59

49.68

3.97

30.81

2.46

35.56

2.84

40.31

3.22

45.06

3.60

49.81

3.98

30.93

2.47

35.68

2.85

40.43

3.23

45.18

3.61

49.93

3.99

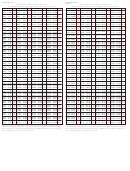

31.06

2.48

35.81

2.86

40.56

3.24

45.31

3.62

50.06

4.00

31.18

2.49

35.93

2.87

40.68

3.25

45.43

3.63

50.18

4.01

31.31

2.50

36.06

2.88

40.81

3.26

45.56

3.64

50.31

4.02

31.43

2.51

36.18

2.89

40.93

3.27

45.68

3.65

50.43

4.03

31.56

2.52

36.31

2.90

41.06

3.28

45.81

3.66

50.56

4.04

31.68

2.53

36.43

2.91

41.18

3.29

45.93

3.67

50.68

4.05

31.81

2.54

36.56

2.92

41.31

3.30

46.06

3.68

50.81

4.06

31.93

2.55

36.68

2.93

41.43

3.31

46.18

3.69

50.93

4.07

32.06

2.56

36.81

2.94

41.56

3.32

46.31

3.70

51.06

4.08

32.18

2.57

36.93

2.95

41.68

3.33

46.43

3.71

51.18

4.09

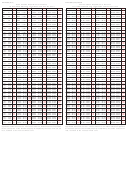

32.31

2.58

37.06

2.96

41.81

3.34

46.56

3.72

51.31

4.10

32.43

2.59

37.18

2.97

41.93

3.35

46.68

3.73

51.43

4.11

32.56

2.60

37.31

2.98

42.06

3.36

46.81

3.74

51.56

4.12

32.68

2.61

37.43

2.99

42.18

3.37

46.93

3.75

51.68

4.13

32.81

2.62

37.56

3.00

42.31

3.38

47.06

3.76

51.81

4.14

32.93

2.63

37.68

3.01

42.43

3.39

47.18

3.77

51.93

4.15

33.06

2.64

37.81

3.02

42.56

3.40

47.31

3.78

52.06

4.16

33.18

2.65

37.93

3.03

42.68

3.41

47.43

3.79

52.18

4.17

33.31

2.66

38.06

3.04

42.81

3.42

47.56

3.80

52.31

4.18

33.43

2.67

38.18

3.05

42.93

3.43

47.68

3.81

52.43

4.19

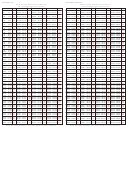

33.56

2.68

38.31

3.06

43.06

3.44

47.81

3.82

52.56

4.20

33.68

2.69

38.43

3.07

43.18

3.45

47.93

3.83

52.68

4.21

33.81

2.70

38.56

3.08

43.31

3.46

48.06

3.84

52.81

4.22

33.93

2.71

38.68

3.09

43.43

3.47

48.18

3.85

52.93

4.23

34.06

2.72

38.81

3.10

43.56

3.48

48.31

3.86

53.06

4.24

34.18

2.73

38.93

3.11

43.68

3.49

48.43

3.87

34.31

2.74

39.06

3.12

43.81

3.50

48.56

3.88

34.43

2.75

39.18

3.13

43.93

3.51

48.68

3.89

34.56

2.76

39.31

3.14

44.06

3.52

48.81

3.90

34.68

2.77

39.43

3.15

44.18

3.53

48.93

3.91

Sales Over $50

How to Figure the Tax

Amount

Tax

Example: Sale is $75.95

$ 60.00

$ 4.80

Tax on . . . . . . . $70.00

$5.60

70.00

5.60

Tax on . . . . . . . . . 5.95

.48

80.00

6.40

Total Tax . . . . . . . . . . . . .

$6.08

90.00

7.20

100.00

8.00

150.00

12.00

200.00

16.00

250.00

20.00

300.00

24.00

Sales Tax Question?

comptroller.texas.gov/taxhelp/

Receive tax help:

Comptroller.Texas.Gov

For more information, visit our website:

Or Call Toll Free 1-800-252-5555 • in Austin 512-463-4600

Sign up to receive e-mail updates on the Comptroller topics of

your choice at comptroller.texas.gov/subscribe.

GLENN HEGAR

Texas Comptroller of Public Accounts

98-253 (01/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2