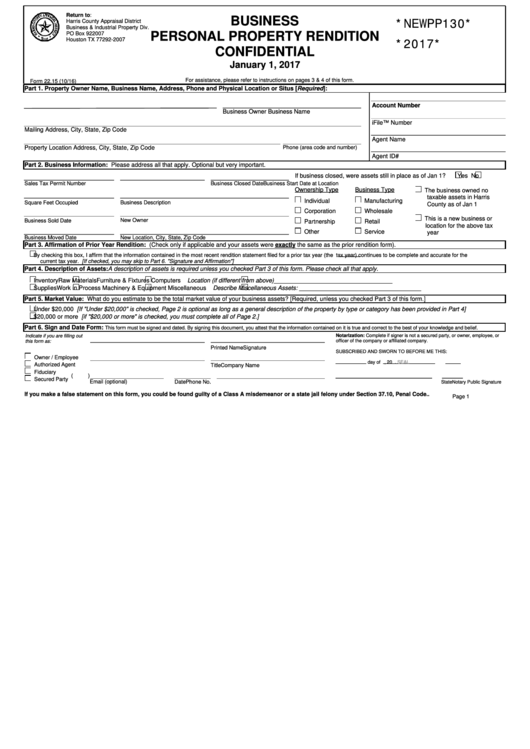

Return to:

BUSINESS

Harris County Appraisal District

*NEWPP130*

Business & Industrial Property Div.

PO Box 922007

PERSONAL PROPERTY RENDITION

Houston TX 77292-2007

*2017*

CONFIDENTIAL

January 1, 2017

For assistance, please refer to instructions on pages 3 & 4 of this form.

Form 22.15 (10/16)

Part 1. Property Owner Name, Business Name, Address, Phone and Physical Location or Situs [Required]:

Account Number

Business Name

Business Owner

iFile™ Number

Mailing Address, City, State, Zip Code

Agent Name

Property Location Address, City, State, Zip Code

Phone (area code and number)

Agent ID#

Part 2. Business Information: Please address all that apply. Optional but very important.

If business closed, were assets still in place as of Jan 1?

Yes

No

Sales Tax Permit Number

Business Start Date at Location

Business Closed Date

Ownership Type

Business Type

The business owned no

taxable assets in Harris

Individual

Manufacturing

Square Feet Occupied

Business Description

County as of Jan 1

Corporation

Wholesale

This is a new business or

New Owner

Business Sold Date

Partnership

Retail

location for the above tax

Other

Service

year

Business Moved Date

New Location, City, State, Zip Code

Part 3. Affirmation of Prior Year Rendition: (Check only if applicable and your assets were exactly the same as the prior rendition form).

By checking this box, I affirm that the information contained in the most recent rendition statement filed for a prior tax year (the

tax year) continues to be complete and accurate for the

current tax year. [If checked, you may skip to Part 6. "Signature and Affirmation"]

Part 4. Description of Assets: A description of assets is required unless you checked Part 3 of this form. Please check all that apply.

Inventory

Raw Materials

Furniture & Fixtures

Computers

Location (if different from above)___________________________________

Supplies

Work in Process

Machinery & Equipment

Miscellaneous

Describe Miscellaneous Assets: ____________________________________

Part 5. Market Value: What do you estimate to be the total market value of your business assets? [Required, unless you checked Part 3 of this form.]

Under $20,000

[If "Under $20,000" is checked, Page 2 is optional as long as a general description of the property by type or category has been provided in Part 4]

$20,000 or more

[if "$20,000 or more" is checked, you must complete all of Page 2.]

Part 6. Sign and Date Form:

This form must be signed and dated. By signing this document, you attest that the information contained on it is true and correct to the best of your knowledge and belief.

Notarization: Complete if signer is not a secured party, or owner, employee, or

Indicate if you are filling out

this form as:

officer of the company or affiliated company.

Signature

Printed Name

SUBSCRIBED AND SWORN TO BEFORE ME THIS:

Owner / Employee

day of

, 20

.

SEAL

Authorized Agent

Company Name

Title

Fiduciary

(

)

Secured Party

Phone No.

Date

Email (optional)

Notary Public Signature

State

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10, Penal Code..

Page 1

1

1 2

2 3

3 4

4