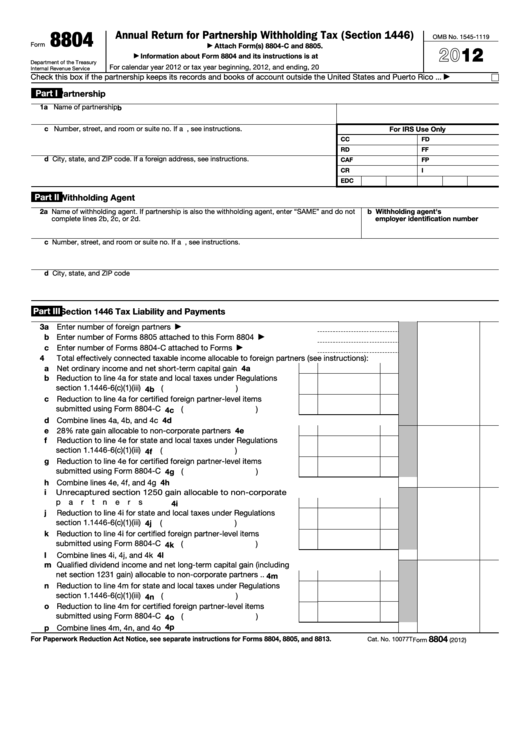

8804

Annual Return for Partnership Withholding Tax (Section 1446)

OMB No. 1545-1119

Form

Attach Form(s) 8804-C and 8805.

▶

2012

Information about Form 8804 and its instructions is at

▶

Department of the Treasury

For calendar year 2012 or tax year beginning

, 2012, and ending

, 20

Internal Revenue Service

Check this box if the partnership keeps its records and books of account outside the United States and Puerto Rico .

.

.

▶

Part I

Partnership

1a Name of partnership

b U.S. employer identification number

c Number, street, and room or suite no. If a P.O. box, see instructions.

For IRS Use Only

CC

FD

RD

FF

d City, state, and ZIP code. If a foreign address, see instructions.

CAF

FP

CR

I

EDC

Part II

Withholding Agent

2a Name of withholding agent. If partnership is also the withholding agent, enter “SAME” and do not

b Withholding agent's U.S.

complete lines 2b, 2c, or 2d.

employer identification number

c Number, street, and room or suite no. If a P.O. box, see instructions.

d City, state, and ZIP code

Part III

Section 1446 Tax Liability and Payments

3a Enter number of foreign partners .

.

.

.

.

.

.

.

.

.

.

.

.

▶

b Enter number of Forms 8805 attached to this Form 8804 .

.

.

.

.

▶

c Enter number of Forms 8804-C attached to Forms 8805

.

.

.

.

.

▶

4

Total effectively connected taxable income allocable to foreign partners (see instructions):

a Net ordinary income and net short-term capital gain .

.

.

.

.

4a

b Reduction to line 4a for state and local taxes under Regulations

section 1.1446-6(c)(1)(iii) .

.

.

.

.

.

.

.

.

.

.

.

.

.

4b (

)

c Reduction to line 4a for certified foreign partner-level items

submitted using Form 8804-C .

.

.

.

.

.

.

.

.

.

.

.

4c (

)

d Combine lines 4a, 4b, and 4c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4d

e 28% rate gain allocable to non-corporate partners

4e

.

.

.

.

.

f

Reduction to line 4e for state and local taxes under Regulations

section 1.1446-6(c)(1)(iii) .

.

.

.

.

.

.

.

.

.

.

.

.

.

4f (

)

g Reduction to line 4e for certified foreign partner-level items

submitted using Form 8804-C .

.

.

.

.

.

.

.

.

.

.

.

4g (

)

h Combine lines 4e, 4f, and 4g

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4h

i

Unrecaptured section 1250 gain allocable to non-corporate

partners

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4i

j

Reduction to line 4i for state and local taxes under Regulations

section 1.1446-6(c)(1)(iii) .

.

.

.

.

.

.

.

.

.

.

.

.

.

(

)

4j

k Reduction to line 4i for certified foreign partner-level items

submitted using Form 8804-C .

.

.

.

.

.

.

.

.

.

.

.

4k (

)

l

Combine lines 4i, 4j, and 4k .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4l

m Qualified dividend income and net long-term capital gain (including

net section 1231 gain) allocable to non-corporate partners

.

.

4m

n Reduction to line 4m for state and local taxes under Regulations

section 1.1446-6(c)(1)(iii) .

.

.

.

.

.

.

.

.

.

.

.

.

.

4n (

)

o Reduction to line 4m for certified foreign partner-level items

submitted using Form 8804-C .

.

.

.

.

.

.

.

.

.

.

.

4o (

)

4p

p Combine lines 4m, 4n, and 4o .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8804

For Paperwork Reduction Act Notice, see separate instructions for Forms 8804, 8805, and 8813.

Cat. No. 10077T

Form

(2012)

1

1 2

2