Electricity Vat Declaration Form - Engie

ADVERTISEMENT

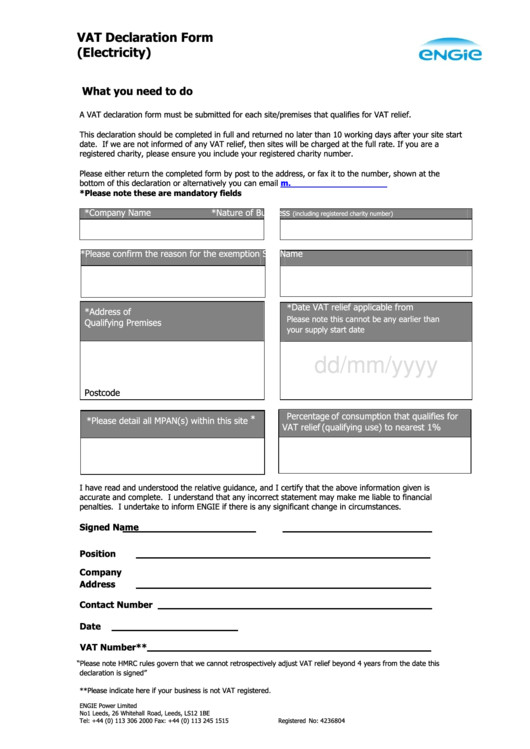

VAT Declaration Form

(Electricity)

What you need to do

A VAT declaration form must be submitted for each site/premises that qualifies for VAT relief.

This declaration should be completed in full and returned no later than 10 working days after your site start

date. If we are not informed of any VAT relief, then sites will be charged at the full rate. If you are a

registered charity, please ensure you include your registered charity number.

Please either return the completed form by post to the address, or fax it to the number, shown at the

bottom of this declaration or alternatively you can email

.

*Please note these are mandatory fields

*Company Name

*Nature of Business

(including registered charity number)

*Please confirm the reason for the exemption

Site Name

* Date VAT relief applicable from

*Address of

Please note this cannot be any earlier than

Qualifying Premises

your supply start date

dd/mm/yyyy

Postcode

* Percentage of consumption that qualifies for

*Please detail all MPAN(s) within this site

VAT relief (qualifying use) to nearest 1%

I have read and understood the relative guidance, and I certify that the above information given is

accurate and complete. I understand that any incorrect statement may make me liable to financial

penalties. I undertake to inform ENGIE if there is any significant change in circumstances.

Signed

Name

Position

Company

Address

Contact Number

Date

VAT Number**

“Please note HMRC rules govern that we cannot retrospectively adjust VAT relief beyond 4 years from the date this

declaration is signed”

**Please indicate here if your business is not VAT registered.

ENGIE Power Limited

No1 Leeds, 26 Whitehall Road, Leeds, LS12 1BE

Tel: +44 (0) 113 306 2000

Fax: +44 (0) 113 245 1515

Registered No: 4236804

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1