DUALTT-AONM-YRXY-MOHJ-EUJY

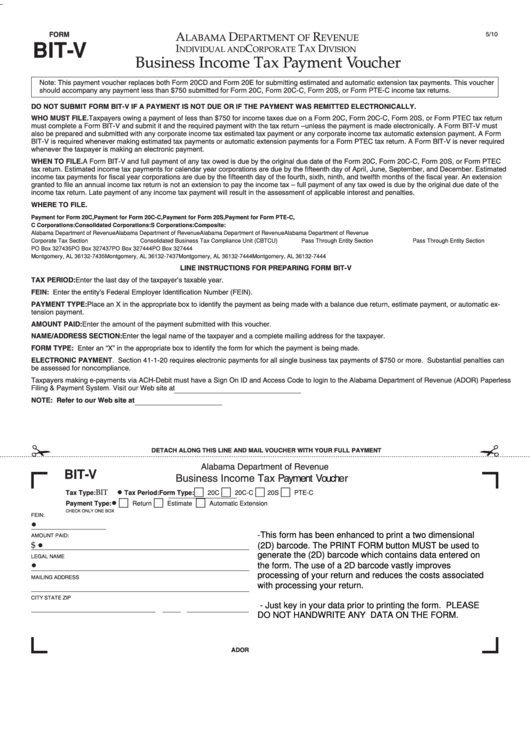

FORM

A

D

R

5/10

LABAMA

EPARTMENT OF

EVENUE

BIT-V

I

C

T

D

NDIVIDUAL AND

ORPORATE

AX

IVISION

Business Income Tax Payment Voucher

Note: This payment voucher replaces both Form 20CD and Form 20E for submitting estimated and automatic extension tax payments. This voucher

should accompany any payment less than $750 submitted for Form 20C, Form 20C-C, Form 20S, or Form PTE-C income tax returns.

DO NOT SUBMIT FORM BIT-V IF A PAYMENT IS NOT DUE OR IF THE PAYMENT WAS REMITTED ELECTRONICALLY.

WHO MUST FILE. Taxpayers owing a payment of less than $750 for income taxes due on a Form 20C, Form 20C-C, Form 20S, or Form PTEC tax return

must complete a Form BIT-V and submit it and the required payment with the tax return – unless the payment is made electronically. A Form BIT-V must

also be prepared and submitted with any corporate income tax estimated tax payment or any corporate income tax automatic extension payment. A Form

BIT-V is required whenever making estimated tax payments or automatic extension payments for a Form PTEC tax return. A Form BIT-V is never required

whenever the taxpayer is making an electronic payment.

WHEN TO FILE. A Form BIT-V and full payment of any tax owed is due by the original due date of the Form 20C, Form 20C-C, Form 20S, or Form PTEC

tax return. Estimated income tax payments for calendar year corporations are due by the fifteenth day of April, June, September, and December. Estimated

income tax payments for fiscal year corporations are due by the fifteenth day of the fourth, sixth, ninth, and twelfth months of the fiscal year. An extension

granted to file an annual income tax return is not an extension to pay the income tax – full payment of any tax owed is due by the original due date of the

income tax return. Late payment of any income tax payment will result in the assessment of applicable interest and penalties.

WHERE TO FILE.

Payment for Form 20C,

Payment for Form 20C-C,

Payment for Form 20S,

Payment for Form PTE-C,

C Corporations:

Consolidated Corporations:

S Corporations:

Composite:

Alabama Department of Revenue

Alabama Department of Revenue

Alabama Department of Revenue

Alabama Department of Revenue

Corporate Tax Section

Consolidated Business Tax Compliance Unit (CBTCU)

Pass Through Entity Section

Pass Through Entity Section

PO Box 327435

PO Box 327437

PO Box 327444

PO Box 327444

Montgomery, AL 36132-7435

Montgomery, AL 36132-7437

Montgomery, AL 36132-7444

Montgomery, AL 36132-7444

LINE INSTRUCTIONS FOR PREPARING FORM BIT-V

TAX PERIOD: Enter the last day of the taxpayer’s taxable year.

FEIN: Enter the entity's Federal Employer Identification Number (FEIN).

PAYMENT TYPE: Place an X in the appropriate box to identify the payment as being made with a balance due return, estimate payment, or automatic ex-

tension payment.

AMOUNT PAID: Enter the amount of the payment submitted with this voucher.

NAME/ADDRESS SECTION: Enter the legal name of the taxpayer and a complete mailing address for the taxpayer.

FORM TYPE: Enter an “X” in the appropriate box to identify the form for which the payment is being made.

ELECTRONIC PAYMENT. Section 41-1-20 requires electronic payments for all single business tax payments of $750 or more. Substantial penalties can

be assessed for noncompliance.

Taxpayers making e-payments via ACH-Debit must have a Sign On ID and Access Code to login to the Alabama Department of Revenue (ADOR) Paperless

Filing & Payment System. Visit our Web site at for additional information.

NOTE: Refer to our Web site at for tax payment and form preparation requirements.

DETACH ALONG THIS LINE AND MAIL VOUCHER WITH YOUR FULL PAYMENT

Alabama Department of Revenue

BIT-V

Print

Reset

Business Income Tax Payment Voucher

• Tax Period:

Tax Type: BIT

Form Type:

20C

20C-C

20S

PTE-C

Payment Type: •

Return

Estimate

Automatic Extension

CHECK ONLY ONE BOX

FEIN:

•

-This form has been enhanced to print a two dimensional

AMOUNT PAID:

•

$

(2D) barcode. The PRINT FORM button MUST be used to

generate the (2D) barcode which contains data entered on

LEGAL NAME

•

the form. The use of a 2D barcode vastly improves

processing of your return and reduces the costs associated

MAILING ADDRESS

with processing your return.

CITY

STATE

ZIP

- Just key in your data prior to printing the form. PLEASE

DO NOT HANDWRITE ANY DATA ON THE FORM.

ADOR

1

1