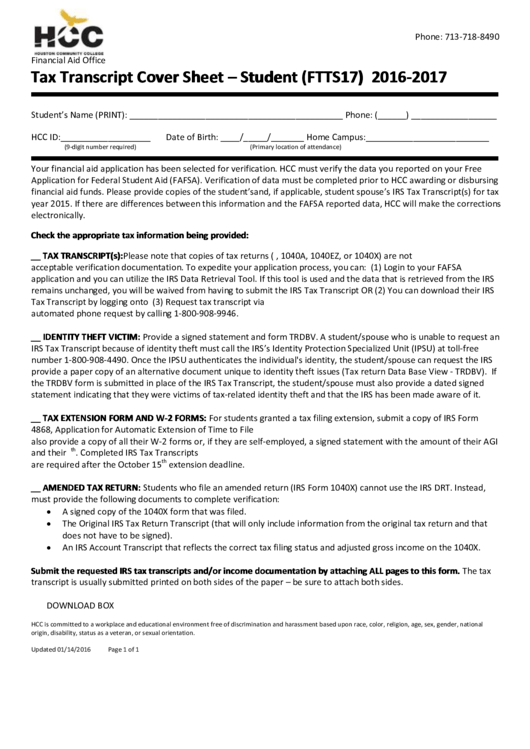

Tax Transcript Cover Sheet Template - Student (Ftts17)

ADVERTISEMENT

Phone: 713-718-8490

Financial Aid Office

Tax Transcript Cover Sheet – Student (FTTS17)

2016-2017

Student’s Name (PRINT): _____________________________________________ Phone: (______) __________________

HCC ID:___________________

Date of Birth: ____/_____/_______ Home Campus:__________________________

(9-digit number required)

(Primary location of attendance)

Your financial aid application has been selected for verification. HCC must verify the data you reported on your Free

Application for Federal Student Aid (FAFSA). Verification of data must be completed prior to HCC awarding or disbursing

financial aid funds. Please provide copies of the student’s and, if applicable, student spouse’s IRS Tax Transcript(s) for tax

year 2015. If there are differences between this information and the FAFSA reported data, HCC will make the corrections

electronically.

Check the appropriate tax information being provided:

__ TAX TRANSCRIPT(s): Please note that copies of tax returns (i.e. Form 1040, 1040A, 1040EZ, or 1040X) are not

acceptable verification documentation. To expedite your application process, you can: (1) Login to your FAFSA

application and you can utilize the IRS Data Retrieval Tool. If this tool is used and the data that is retrieved from the IRS

remains unchanged, you will be waived from having to submit the IRS Tax Transcript OR (2) You can download their IRS

Tax Transcript by logging onto OR (3) Request tax transcript via

automated phone request by calling 1-800-908-9946.

__ IDENTITY THEFT VICTIM: Provide a signed statement and form TRDBV. A student/spouse who is unable to request an

IRS Tax Transcript because of identity theft must call the IRS’s Identity Protection Specialized Unit (IPSU) at toll-free

number 1-800-908-4490. Once the IPSU authenticates the individual's identity, the student/spouse can request the IRS

provide a paper copy of an alternative document unique to identity theft issues (Tax return Data Base View - TRDBV). If

the TRDBV form is submitted in place of the IRS Tax Transcript, the student/spouse must also provide a dated signed

statement indicating that they were victims of tax-related identity theft and that the IRS has been made aware of it.

__ TAX EXTENSION FORM AND W-2 FORMS: For students granted a tax filing extension, submit a copy of IRS Form

4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. The student/spouse must

also provide a copy of all their W-2 forms or, if they are self-employed, a signed statement with the amount of their AGI

th

and their U.S. income taxes paid. Tax extensions will not be accepted after October 15

. Completed IRS Tax Transcripts

th

are required after the October 15

extension deadline.

__ AMENDED TAX RETURN: Students who file an amended return (IRS Form 1040X) cannot use the IRS DRT. Instead,

must provide the following documents to complete verification:

A signed copy of the 1040X form that was filed.

The Original IRS Tax Return Transcript (that will only include information from the original tax return and that

does not have to be signed).

An IRS Account Transcript that reflects the correct tax filing status and adjusted gross income on the 1040X.

Submit the requested IRS tax transcripts and/or income documentation by attaching ALL pages to this form. The tax

transcript is usually submitted printed on both sides of the paper – be sure to attach both sides.

DOWNLOAD BOX

HCC is committed to a workplace and educational environment free of discrimination and harassment based upon race, color, religion, age, sex, gender, national

origin, disability, status as a veteran, or sexual orientation.

Updated 01/14/2016

Page 1 of 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2